Disclaimer: We sometimes use affiliate links in our content. For more information, visit our Disclaimer Page.

In the last decade, we’ve seen an increase in startups and businesses cutting out intermediaries and going straight to consumers. This is called disintermediation, and it has been happening across industries such as retail, finance, marketing, advertising, transportation…the list goes on.

With this increasing trend, companies such as Uber are leading the way by connecting drivers with riders without interference from a taxi company or other third party previously involved in these types of transactions. So what does this mean for your business? Join me as I explore this trend in more detail.

What is Disintermediation?

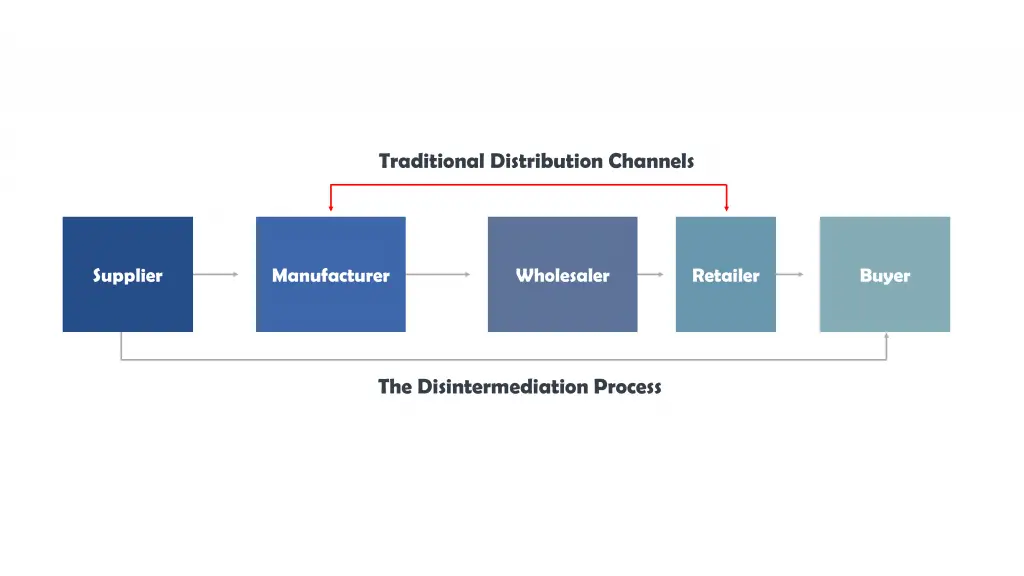

Before we talk about leveraging disintermediation, let’s first go over precisely what disintermediation means. The term “disintermediation” refers to the act of removing intermediaries from a transaction. It might occur in a variety of commercial transactions. However, it’s most often used to refer to the disintermediation of producers and customers.

When someone or something takes away an intermediary from a transaction between two parties (e.g., direct sales), that action is known as disintermediation.

Disintermediation is often associated with disrupters such as Amazon or Uber – companies that have caused significant changes to their industries by cutting out middlemen (e.g., traditional brick-and-mortar retailers).

However, disintermediating isn’t only limited to these industry disrupters! Any company has some degree of control over how much they choose to involve intermediaries to complete a transaction. Companies can disintermediate instead of intermediaries like wholesalers or other retailers by selling directly to consumers.

Related: Reintermediation

Disintermediation: the history, cause, and future.

Disintermediation is said to have originated in 17th century England when farmers were able to sell their goods themselves rather than through traditional merchants who acted as middlemen.

The term “disintermediation” was initially applied to the banking industry in 1967. Consumers invest directly in securities (government and private bonds and stocks) rather than leaving their money in savings accounts. The original cause of this shift was a U.S government regulation that limited interest rates paid on insured bank deposits.

At first, many saw disintermediation as harmful towards business; however, it quickly became apparent that disintermediated transactions could be more profitable because they are conducted at lower costs due to less regulation from authorities such as the government and banks.

In addition, transactions that are not mediated can also be more profitable. This is because these types of transactions do not have the costs of working with a mediator.

Disintermediation has become an increasingly popular trend in business transactions, perhaps most notable being its use in the music industry. For example, artists such as Radiohead have made it possible for their customers to buy albums directly from them. This was seen by many as revolutionary at first but is now becoming a regular practice among musicians and other entertainers who are looking to cut out record companies that take up large portions of album sales.

Today, many businesses are making money without using an intermediary. Some people worry that this might change society at small and large levels. Disintermediation might affect how business is done throughout the whole industry.

What is the primary benefit to consumers of disintermediation?

The disintermediation of businesses is a massive step in the right direction for consumers. The removal of intermediaries allows customers to have more control over how they spend their money and where it goes after leaving their pockets.

Since disintermediators often sell directly from producers or manufacturers, no unnecessary added costs can inflate the prices of goods and services. This means that disintermediated products are usually cheaper than those with an intermediary involved.

With disintermediation comes transparency as well – instead of purchasing something through someone else who adds markup on top of what was paid by the producer, you deal directly with them (which results in lower prices). And when both parties are open about pricing and fees, it makes disintermediated transactions more trustworthy than traditional ones.

What does disintermediation mean in business?

Disintermediation is the process of removing a middleman from a transaction or supply chain. It can be used to reduce costs and increase efficiency. In business, disintermediation can occur when a company cuts out the traditional intermediaries such as agents, brokers, or distributors and deals directly with suppliers or customers.

This can provide cost savings and a more streamlined process. However, disintermediation can also lead to increased risk if the company does not have the necessary expertise or resources to manage the new direct relationships.

Disintermediation is often driven by technological advances that allow companies to bypass traditional intermediaries. For example, the internet has allowed businesses to sell products directly to consumers without a middleman. This has led to the rise of online retailers such as Amazon and eBay, which have cut out traditional intermediaries such as brick-and-mortar shops.

Today, disintermediation has become even more common due to advancements in technology, such as PayPal’s invention of online payments for P-to-P (person-to-person) transfers where users do not have account information associated with each other. With this innovation, disintermediation has spread to every sector, from retail to manufacturing and real estate to even some disintermediated services such as house care.

Disintermediation also helps workers seek out jobs that fit their specific needs rather than being forced into one job for a lifetime. Also, disintermediated businesses allow smaller companies and individuals with less capital access to larger markets they could previously only dream of entering until disintermediation became common practice.

What are the examples of disintermediation?

Disintermediation is the disassociation of an intermediary from either a business transaction or social relationship. In more traditional transactions, intermediaries are used to reducing costs and perform tasks that would be time-consuming for businesses in their attempts to connect with consumers.

For example, real estate agents can make it easier for property owners to sell houses by advertising them online through websites like Zillow or Realtor.com.

However, disintermediation may cause these middlemen to lose their place as key players between suppliers and customers because technology has made it possible for companies to conduct many of these functions more efficiently without outside help.

Some examples of companies include:

- Companies like Dell and Apple have successfully created brands that are recognized by their customers, resulting in continuous growth. This is done through disintermediation—selling products directly to consumers instead of using traditional retail chains.

- Airbnb disintermediates the hotel industry by allowing consumers to rent out their homes or spare rooms for short periods. This service has grown in popularity over recent years, but some have argued that it creates tension between hotels and local governments.

- Uber disintermediated the taxicab business by connecting passengers directly with drivers through a platform provided on their smartphones. However, this company has faced legal challenges from many cities because government officials argue that these services do not follow public transit regulations.

- Travel agents are disintermediated by websites like Expedia, which allow customers to book their plane tickets without an agent’s help. This has caused many travel agencies worldwide to close down entirely either-or move into other areas of consumer services such as insurance or car rentals.

- On an international level, disintermediation can be seen with Alibaba’s online platforms that connect Chinese suppliers and customers located across the globe.

The Advantages and Disadvantages of Disintermediation

In terms of disintermediating an industry, this involves removing layers between producers and consumers to create more direct connections with fewer steps in-between, which often results in lower costs.

Technology and the economy can sometimes cause a company to stop using intermediaries. Sometimes this is because of a merger or an acquisition. In these cases, one company buys another company instead of building its distribution channels and sales team.

Disintermediation can have several advantages for businesses or consumers but also some disadvantages.

For example, disintermediation can lead to lower costs & prices for consumers due to increased competition. It may also allow a more direct connection between producers and the final consumer.

However, disintermediation can also have disadvantages, such as affecting the traditional supplier-distribution relationships within an industry. This may negatively impact jobs and lead to a loss of specialized know-how & skills throughout the supply chain.

For example, disintermediation in the banking industry has led to job losses for bank tellers and other workers who held high-skilled positions.

In addition, disintermediation can also lead to a lack of control over product quality and availability and increased risk due to new forms of intermediaries taking on roles traditionally reserved for suppliers or distributors. This is particularly true when disintermediated products are purchased online without the ability to touch or inspect the physical item before purchase.

Finally, disintermediation changes industries through changing market structures and increasing competitive pressures among suppliers who have more power over distributors than ever before. This can lead to uncompetitive behavior, including predatory pricing and withholding essential inputs.

How to Leverage Disintermediation to Your Advantage

Disintermediating a transaction between the producer and consumer is often difficult for many companies because it involves putting yourself in direct contact with your customers – something that not all businesses are equipped or prepared to handle. However, there’s still plenty of room for you to take advantage of disintermediation! Here are some tips on how:

- Reduce costs: disintermediated transactions typically bypass third parties who charge fees; this means that if you’re able to cut out these middlemen (e.g., wholesalers), then you’ll be able to save money on production while also charging less than what the disrupters are charging.

- Reach a larger audience: disintermediation allows companies to reach consumers that they otherwise wouldn’t have been able to without the use of intermediaries, which can lead to greater exposure and more sales! Disruptors often take advantage of disintermediating by selling their products directly through online sites; however, this doesn’t mean that you need an eCommerce website or business model to disintermediate your transactions – any way you can sell directly will do!

- Be unique: while disrupters like Amazon and Uber tend not only to focus on consumer convenience but also emphasize low price points (and sometimes even both), other businesses may choose different focuses for thematic reasons. You don’t have to disintermediate in the same way as others!

When disintermediation works well for companies, it’s because they’ve been able to leverage these benefits while also keeping themselves relevant and unique. Disintermediation can be difficult at first, but with careful planning, you’ll find that there are plenty of advantages waiting for your company just around the corner!

Related: Create an Outstanding Lean Management Plan for Your Business

Conclusion

The trend of disintermediation is continuing to grow. As these companies continue to disrupt industries, they also change how consumers interact with brands and products. If you haven’t considered your involvement in this trend yet, it may be time for a re-think of how you market yourself online or offline (or both).

Join the conversation by sharing our blog post on social media or subscribing to receive updates from us via email about other trends that will affect marketing strategies in the future!