Disclaimer: We sometimes use affiliate links in our content. For more information, visit our Disclaimer Page.

As a small business owner, managing finances can be challenging. Accounting software offers a solution, streamlining financial tasks.

When searching for the best accounting software for small businesses, you may want to consider expert services to streamline your financial operations. You can explore options like Sleek UK for professional assistance.

Choosing the right software is crucial, and this article aims to guide you through the best options available.

How We Chose Accounting Software for Small Businesses?

When it comes to running a small business, there are a lot of essential details to keep track of. From invoicing and payroll to inventory and taxes, there is a lot of information to manage. This is where accounting software can come in handy. Accounting software can help business owners keep track of their finances and ensure that everything is in order.

However, with so many different accounting software programs on the market, it can be hard to know which one is right for your business. There are a few things to keep in mind when choosing accounting software for your small business.

First, consider your specific needs. Then, make a list of the most important features to you and look for software that offers those features.

Second, take into account the cost. Some accounting software programs are costly, while others are more affordable. Determine what you are willing to spend and look for programs that fit within your budget.

Finally, think about ease of use. The best accounting software in the world won’t do you any good if you can’t figure out how to use it.

Choose a program that is user-friendly and easy to navigate. By keeping these factors in mind, you can be sure to choose the right accounting software for your small business.

Related: Best Free Bookkeeping Software for Small Business

What Does Accounting Software for a Small Business Do?

Accounting software helps businesses keep track of their finances. This includes income, expenses, assets, liabilities, and equity. It can also track invoices, customers, and vendors. Most programs also allow businesses to generate financial reports. This information can be used to make informed decisions about allocating resources.

By automating many of the tasks associated with bookkeeping, accounting software can save small business owners valuable time and energy. In addition, the software can help to ensure accuracy by automatically tracking transactions and generating reports.

Accounting software can provide a foundation for sound financial management for businesses that are just getting started. By keeping track of income and expenses, companies can better understand their financial health and make informed decisions about where to allocate their resources.

For established businesses, accounting software can help to streamline operations and keep track of growth. In short, accounting software is a valuable tool for small businesses of all sizes.

Ensuring accurate tax returns is paramount for small businesses, and the right accounting software can significantly streamline this process, minimizing errors and maximizing efficiency.

The Role of Asset Management in Small Business Finances

While accounting software is pivotal for tracking income, expenses, and other financial metrics, it’s equally crucial for businesses to have a comprehensive understanding of their assets.

Effective asset management ensures that a company’s tangible and intangible assets are maintained, accounted for, and put to their best possible use. By integrating asset management practices with your chosen accounting software, small businesses can achieve a holistic view of their financial health, ensuring that assets contribute positively to the bottom line.

Best Accounting and Invoicing Software for Small Business of 2023

In 2023, the right accounting software is crucial for small businesses. It simplifies financial tasks, ensuring accuracy and efficiency. With many options available, it’s vital to pick one that fits your business’s needs.

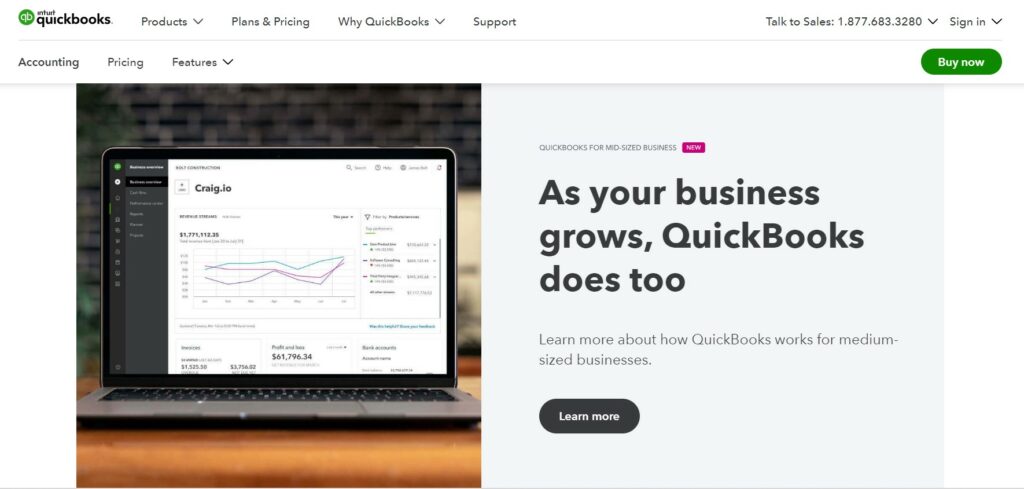

Best Overall: QuickBooks Online

Intuit’s QuickBooks Online is cloud-based accounting software that offers small businesses simple and efficient tools for managing their finances. It has all the features of the desktop version of QuickBooks, plus some added extras, such as the ability to create invoices and estimates on the go, track expenses with photos of receipts, and send payments via credit card or bank transfer.

The software saves businesses time and money by automating bookkeeping, invoicing, and tracking expenses. QuickBooks Online also makes it easy to stay compliant with tax laws and regulations, as all financial data is stored securely in the cloud. Overall, QuickBooks Online is an excellent choice for small businesses looking for a comprehensive and user-friendly accounting solution.

Project Accounting

QuickBooks Project Accounting allows you to create projects and assign wages, income, and expenses to those projects. This can be extremely useful for contractors who want to track costs associated with specific projects. QuickBooks Online also allows you to create project estimates, but unfortunately, you cannot set up cost estimates for projects and compare them to actual costs.

With Project Accounting, you can track the progress of your projects and ensure that they are completed on time and within budget. In addition, QuickBooks Online allows you to generate reports that can help you improve your project management process.

Fixed Assets

One key feature of QuickBooks Online is Fixed Assets management, which allows users to track and manage their company’s assets. To record the purchase of a fixed asset, users can either use the standard A/P feature or record it through a journal entry.

Once an asset is recorded, there are no options for creating a fixed asset schedule or calculating depreciation. However, users can still track their assets and monitor their value over time.

QuickBooks Online may not be the best option for businesses that need more comprehensive asset management features. However, for those who just need basic asset tracking capabilities, QuickBooks Online’s Fixed Assets feature is a helpful tool.

Reporting

QuickBooks Online Reporting provides users with customizable, real-time insights across their business. With over 100 reports available, users can slice and dice their data to better understand where their business is today and where it is headed. For example, the P&L statement provides a snapshot of a business’s sales, expenses, and profit for a given period.

This report can be customized to show data for a specific time, account, or class. Meanwhile, the cash flow statement tracks all of the inflows and outflows of cash for a business. This report can be invaluable in forecasting future cash needs and preventing surprises.

QuickBooks Online also features a robust set of sales reports that can be grouped by customer, location, or class. These reports can help businesses track their progress toward sales goals and identify areas of opportunity.

Pricing:

- Simple Start – $4.80

The Simple Plan includes all the essential features you need to get started, including the ability to send custom invoices and quotes, connect your bank account, and track VAT. Plus, it’s easy to add your accountant so they can access your books and offer advice when needed.

Best of all, the Simple Plan is affordably priced at just £4.80 per month. So if you’re looking for a simple way to manage your finances, QuickBooks Online is worth considering.

- Essentials – $7.50

The Essentials plan from QuickBooks Online is perfect for small businesses that need to track their finances and manage their employees. The plan includes insights and reports, employee management, multi-currency support, and access for three users plus your accountant.

The reports and insights give you the information you need to make sound financial decisions, while the employee management features help you keep track of time off, payroll, and benefits.

And with multi-currency support, you can easily do business with customers and suppliers in different countries. The Essentials plan is great for small businesses that need QuickBooks Online’s powerful features.

- Plus – $10.20

The Plus Plan from QuickBooks Online is a comprehensive accounting solution that offers a wide range of features to suit the needs of businesses of all sizes. The Plus Plan includes everything in the QuickBooks Online Essentials Plan, plus additional features such as tracking inventory, managing budgets, and tracking projects and locations.

This Plan also allows up to five users, plus your accountant, to access your QuickBooks Online account. With the Plus Plan, you can ensure that you have all the tools to run your business effectively and efficiently.

Product Quality Score: 9.5 (Excellent)

- Features: 9.5

- Ease to use: 10

- Pricing: 9

- Customer support: 9.5

Pros

- Excellent user experience and navigation

- Feature-rich dashboard

- Enhanced onboarding

- Wide range of customizable reports

Cons

- The mobile app can’t record the time worked

Related: QuickBooks Review

Best for Automation: Zoho Books

Zoho Books is an excellent option for small businesses looking for affordable, cloud-based accounting software. It offers tons of features, including costing, payroll, expense tracking, and bookkeeping. In addition, it seamlessly syncs with other apps like Dropbox and Google Sheets for easy financial management.

Zoho Books is a great tool for small businesses to keep track of their finances and manage their money. Zoho Books is perfect for small businesses on a budget, thanks to its affordable pricing plans and wide range of features. Zoho Books is also accessible from anywhere, making it a great tool for busy business owners who need to manage their finances on the go.

It is extremely user-friendly accounting software that makes managing your finances a breeze. The interface is sleek and easy to navigate, and the features are comprehensive yet not overwhelming. So whether you’re looking to track expenses, manage invoices or run payroll, Zoho Books has you covered.

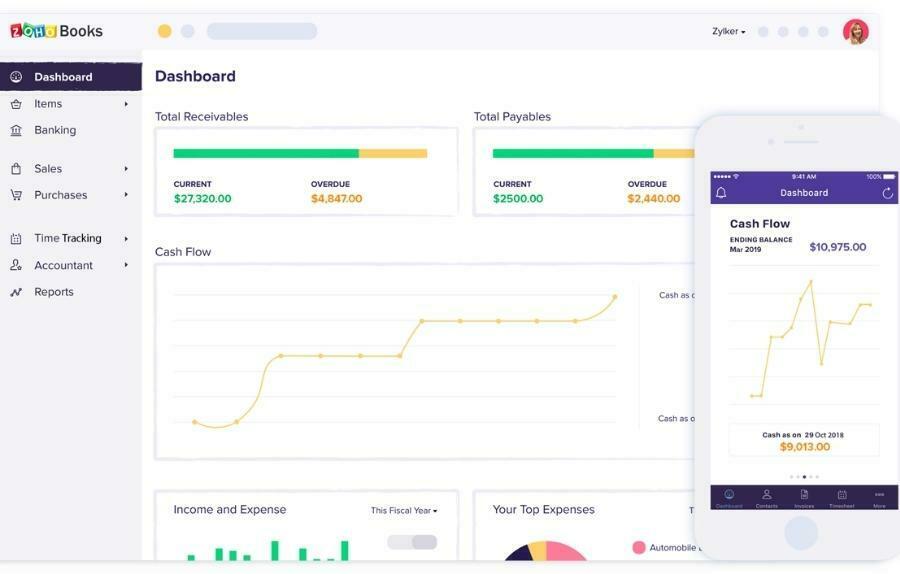

Dashboard

One of the most valuable features of Zoho Books is the feature-rich dashboard. The dashboard features graphs for Total Receivables, Total Payables, Cash Flow, Income and Expenses, Projects, and Bank and Credit Cards. This makes it easy to see at a glance how your business is doing financially.

The Total Receivables and Total Payables graphs are handy for keeping track of accounts receivable and accounts payable. In addition, the Cash Flow graph helps track cash flow daily, and the Income and Expense graph helps see where your money is going each month.

Invoicing

Zoho Books provides a comprehensive invoicing solution that offers a wide range of features to help businesses streamline their invoice management process. With 16 templates and a wide range of customization options, Zoho Books allows firms to create invoices tailored to their specific needs.

Additionally, sending recurring invoices or auto-schedule invoices in advance makes it easy to keep on top of billing and avoid late payments. Furthermore, Zoho Books integrates with many popular payment processors so that you can get paid faster.

Contact Management

Zoho Books offers a contact management system that helps you keep track of customers and vendors. You can add basic contact information, multiple contact persons, custom fields, reporting tags, internal notes, and more. This allows you to have all the information you need about a contact in one place. Additionally, you can use the reporting features to generate reports on your contacts.

This is helpful for sales and marketing teams who need to track their progress with clients. Finally, the internal notes feature allows you to make notes about a contact that only you can see. This is useful for keeping track of personal thoughts or reminders. Overall, the contact management system in Zoho Books is robust and comprehensive, making it a valuable tool for any business.

Pricing:

- Free

The free plan comes with 1 user and 1 accountant. It includes client management, invoice management, online/offline payments, and a client portal.

With Zoho Books, businesses can easily keep track of their finances and manage their clients in one centralized place. In addition, the free plan allows companies to send up to 1,000 invoices per year, making it a great option for small businesses or businesses just getting started.

- Standard – $10

With Zoho Books’ Standard plan, you can manage up to 5,000 invoices, track recurring expenses, and connect and fetch bank & credit card feeds. This is an excellent solution for small businesses that need to keep track of their finances without overspending on accounting software. A Standard plan is also a good option for companies that are just starting and need an affordable way to manage their finances. Overall, the Standard plan from Zoho Books is a great option for small businesses that need basic accounting features at an affordable price.

- Professional – $20

The Professional Plan from Zoho Books is an excellent choice for small businesses that need to track their sales, invoices, bills, and payments. The Sales Approval feature ensures that all sales are properly authorized, while the Retainer Invoices tool allows businesses to bill their clients regularly.

The Billings keeps track of all expenses, and the Payments tool ensures that all vendor credits are properly applied. In addition, the Professional Plan provides access to Zoho Books’ extensive online support resources. As a result, it is an ideal solution for businesses that need a comprehensive invoicing and accounting solution.

- Premium – $30

Zoho Books’ Premium plan is designed for businesses with more complex needs. It includes all the features of the Professional plan, plus additional features such as multi-branch support, a custom domain, vendor management, and budgeting.

With the Premium plan, businesses have everything they need to manage their finances in one place. This plan is available for $30 per month, with discounts for annual plans.

Product Quality Score: 9.1 (Excellent)

- Features: 9

- Ease to use: 8.5

- Pricing: 10

- Customer support: 9

Pros

- Multiple payment gateways

- Document management

- Generous support options

- Generous free plan

Cons

- Not suitable for large businesses

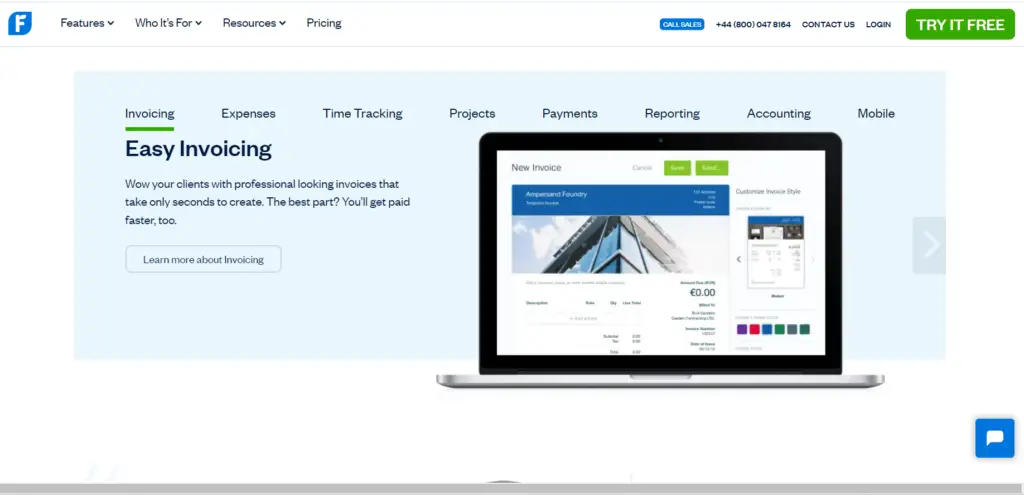

Best for Service-Based Businesses: FreshBooks

FreshBooks is cloud-based accounting software that is designed for small businesses. It makes it easy to track your expenses and invoice customers. The software also offers time-tracking features to see how much time you spend on each project.

FreshBooks also integrates with various other business software so that you can manage all of your business tasks in one place. This makes it an ideal solution for businesses that need to keep track of their finances and projects in one central location. Additionally, integrating other business software means that you can manage all of your business tasks from a single platform.

This can save you time and money by avoiding switching between multiple software programs. Overall, FreshBooks is a great choice for businesses that need an easy-to-use accounting solution that integrates with other business software. In addition, the software has a free trial period, so you can try it before purchasing a subscription.

Sales & Income Tax

FreshBooks allows users to add sales tax items to their bills, expenses, invoices, credit notes, and other income and vendor transactions. Unfortunately, although FreshBooks enables users to track sales taxes, they have to manually set up the sales tax for each jurisdiction. This can be a bit of a hassle for users who have to juggle different tax rates and regulations.

However, tracking sales tax data is still a valuable feature for users who need to stay on top of their finances. FreshBooks is a helpful tool for managing income and expenses, but it could be improved by streamlining the sales tax setup process. Regardless

Inventory Management

With FreshBooks, you can easily monitor your inventory and ensure that you always have the items you need on hand. The software includes an intuitive interface that makes it easy to see how much of each item you have in stock. You can also set up low-stock alerts to never run out of the products your customers need.

In addition, FreshBooks’ inventory management features allow you to track the cost of goods sold so that you can see the financial impact of your inventory levels. FreshBooks makes managing inventory simple and easy, so you can focus on running your business.

Reporting

FreshBooks offers comprehensive reporting features that allow business owners to track their financial performance easily. The reports available include A/R aging, A/P aging, income or loss by month or by the customer, trial balance, and general ledgers. This allows businesses to see where their money is coming in and going out and keep tabs on their overall financial health.

The reports can be customized to show specific periods, customers, or other criteria, making it easy to find the most relevant information. FreshBooks’ reporting features are invaluable for business owners who want to stay on top of their finances and make informed decisions about their business.

Pricing:

- Lite – $6

The FreshBooks Lite plan allows you to send unlimited invoices to up to 5 clients, track expenses, and send estimates. You can also get paid with credit cards and bank transfers.

The FreshBooks Lite plan is ideal for small businesses and freelancers who need a simple way to manage their finances. The Lite plan is a great way to get started with FreshBooks and see how it can help you save time and money. With the Lite plan, you can try out all the features of FreshBooks and upgrade at any time if you need more flexibility or power.

- Plus – $10

The FreshBooks Plus Plan is ideal for businesses that need to track expenses and automatically capture receipt data. With this plan, you can send unlimited estimates and proposals, get paid with credit cards and bank transfers, and set up recurring billing and client retainers.

The Plus Plan also includes all of the features of the Basic Plan, such as invoicing, time tracking, and online payments. The Premium Plan offers even more options if you need more advanced features, including project management and team collaboration tools. Regardless of which plan you choose, FreshBooks makes it easy to manage your finances and get paid faster.

- Premium – $20

The FreshBooks Premium plan is an all-in-one plan that FreshBooks offers, and it includes complete features that you need to run your business effectively. For example, you can send an unlimited number of invoices to an unlimited number of clients with the Premium plan.

You can also track bills and vendor payments with Accounts Payable. Plus, you can track project profitability and customize email templates with dynamic fields. The Premium plan also allows you to customize your email signature.

Product Quality Score: 9.1 (Excellent)

- Features: 9

- Ease to use: 9.5

- Pricing: 9

- Customer support: 9

Pros

- Intuitive and easy to use

- Double-entry accounting reports feature

- Intuitive and easy to use

- Unlimited invoices in all plans

Cons

- Can’t track income or expenses by class

Best for Micro-Business Owners: Xero

Xero is a robust software system for accountants, bookkeepers, and small businesses. With Xero, you can manage your bank accounts, reconcile balances and spot errors, pay your vendors hassle-free, and prepare financial reports.

The best part is that Xero integrates seamlessly with many other software systems, making it easy to keep track of all your business finances in one place. Furthermore, Xero’s customer support is top-notch, so you can always get help when you need it.

Customizable Reports and Dashboards

Xero features customizable reports and dashboards that help users transform data into actionable information. For example, the dashboard summarizes a business’s financial health, including total cash in and out, outstanding invoices, and overdue bills.

Users can drill down into specific areas for more detailed information. Xero also offers a variety of pre-built reports that can be customized to meet particular needs. And for those who want even more control, the Xero API allows businesses to build their custom reports and dashboards.

Unlimited Users

One of the most valuable features of Xero is the ability to add an unlimited number of users to your account. This is especially helpful for businesses that have multiple employees, as it allows each employee to have access to the financial information they need.

You can also set permission levels for each user to control who has access to sensitive information. Overall, the ability to add unlimited users is a great way to help manage your business finances and keep everyone on the same page.

Inventory Management

Inventory management is a vital part of any business, and Xero offers a range of features to help companies keep track of their stock. With Xero, companies can add inventory items, track stock levels, set reorder points, and generate purchase orders. They can also track stock movements and see where inventory is being used.

Moreover, businesses can use Xero’s inventory reports to monitor stock levels and assess the performance of their business. By utilizing these features, companies can ensure that they have the right level of stock on hand at all times, saving both time and money.

Pricing:

- Early – $12

The early plan from Xero starts at just $12 per month, making it an extremely affordable option for small businesses. With this plan, you can send quotes and invoices to your customers, reconcile bank transactions, and enter bills. In addition, you can use Hubdoc to capture bills and receipts, which makes it easy to keep track of your expenses.

The early plan also includes a short-term cash flow report and a business snapshot that provides an overview of your business’s performance.

- Growing – $34

The Growing plan is ideal for small businesses that are expanding their operations. With this plan, you’ll be able to reconcile an unlimited number of transactions, use multiple currencies, and enter an unlimited number of bills.

This plan also allows you to connect with up to 20 business bank accounts and five advisors. So if you’re looking for a comprehensive solution that will help you take your business to the next level, the Xero Growing Plan is perfect.

- Established – $65

The Established Plan from Xero is perfect for businesses that need to track projects, claim expenses, and view in-depth analytics. With this plan, companies can send unlimited invoices and quotes, and they’ll have access to all of the features they need to manage their finances effectively.

The price for this plan is $65 per month, making it an excellent value for businesses that need a robust accounting solution. In addition, with Xero’s 30-day free trial, companies can try out the Xero before committing to it, ensuring that it fits their needs.

Product Quality Score: 9 (Excellent)

- Features: 10

- Ease to use: 10

- Pricing: 9

- Customer support: 7

Pros

- Improved security

- Critical business views

- Unlimited users

- Numerous integrations

Cons

- Poor customer support

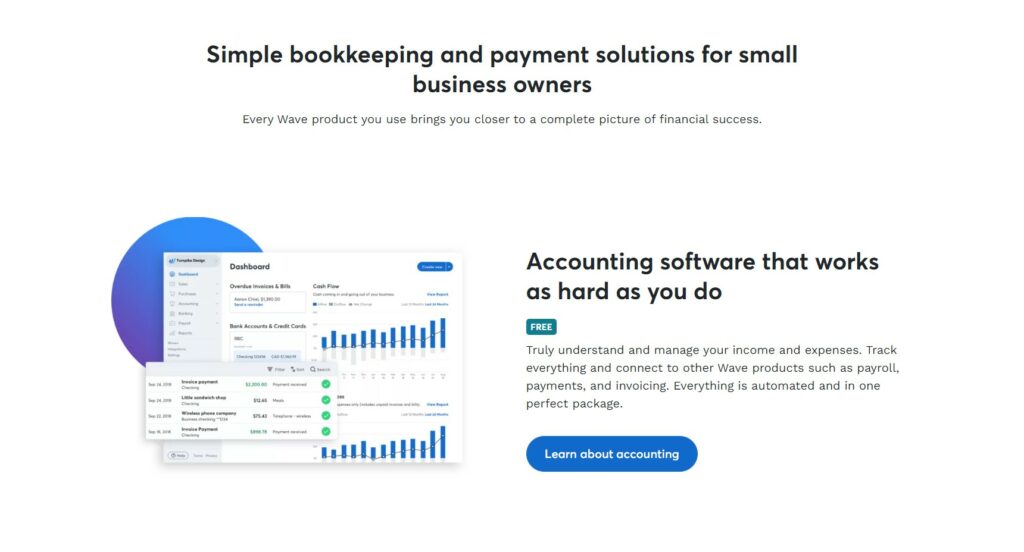

Best Free Accounting Software: Wave

Wave Accounting is one of the most popular accounting software programs for small businesses. It is easy to use, with features like invoicing, tracking expenses, and paying employees. Wave also offers a suite of tools to help you grow your business, like forecasting and goal setting.

Wave is free to use, making it an attractive option for small businesses. The software is straightforward to navigate. In addition, the dashboard offers several features to help you manage your business finances. For example, you can set financial goals and track your progress over time.

Wave also offers a forecasting tool to help you plan for future expenses. Wave Accounting is a great option for small businesses that need accounting software. It is easy to use and provides features to help you manage your finances.

Invoices & Estimates

Wave’s invoice and estimate feature is a great way to streamline your billing process. With just a few clicks, you can create and send invoices. Moreover, Wave also offers customization options to make your life even easier.

You can set up automatic reminders for when invoices are due or automate the entire billing process by linking Wave to other software. Wave’s invoicing, and estimation features are some of the most user-friendly and helpful in the industry, making it a great choice for small businesses.

Client Payments

Wave’s client payment feature is simple. After creating an estimate and getting approval from the client, Wave allows you to generate an invoice with the click of a button quickly.

The client can then choose their preferred payment method, and Wave will handle the rest. This makes it easy to get paid for your work without chasing down payments or worrying about late fees.

Thrid-Party Integrations

Wave’s integrations with third-party software make it an even more powerful tool for businesses. Businesses can get more work done and expand their functionality by connecting Wave to tools like HubSpot, Google Sheets, Shopify, Stripe, Square, PayPal, Etsy, and BlueCamroo.

These integrations allow businesses to connect their accounting software to their CRM, e-commerce platforms, marketing tools, and more. This ensures that all of your business’s data is in one place so you can make informed decisions about your business. Wave’s integrations make it an essential tool for any business.

Pricing:

- Free

Wave is a free solution for small businesses and entrepreneurs looking for an easy way to track their income and expenses. The Wave app is simple and offers a fully functional double-entry system, making it easy to generate financial statements for year-end.

Furthermore, it allows users to add unlimited partners, collaborators, or accountants, making it an excellent solution for businesses. And with Wave’s sales tax tracking feature, users can be sure that they are compliant with all tax laws. So whether you’re just starting or an established business, Wave’s free plan is a great choice for your accounting needs.

Product Quality Score: 9.1 (Excellent)

- Features: 9.5

- Ease to use: 9

- Pricing: 10

- Customer support: 8

Pros

- Excellent invoice and transaction management

- Great dashboard

- Multicurrency support

- Customizable invoicing

- Easy to use

Cons

- Limited customer service

Best for Multiple Users: Sage 50cloud Accounting

Sage 50cloud Accounting software is the perfect solution for small businesses that need a comprehensive and easy-to-use accounting solution. It offers a variety of features such as cloud computing integration, multi-currency support, tax calculations, planning options, and live support.

With Sage 50cloud Accounting software, you can ensure that your finances are in good hands. In addition, the software is constantly updated with the latest tax laws and regulations, so you can be confident that your taxes are being handled correctly. Overall, Sage 50cloud Accounting is an incredible choice for small businesses that need an easy-to-use and affordable accounting solution.

Vendors and purchases

The Vendors & Purchases navigation center in Sage 50cloud Accounting allows you to manage your vendor information just as entirely as you can manage your customers. You can choose from up to 10 payment methods to pay your vendors, including convenient options such as payment through PayPal, electronic payments, credit cards, and standard payment options such as cash and checks. This complete control over vendor management makes Sage 50cloud Accounting an invaluable tool for any business.

Employees and Payroll

Payroll is a vital but often daunting task for small businesses. In addition to keeping up with tax laws, companies must also ensure that their employees are paid accurately and on time. Sage 50cloud Accounting offers a self-service payroll option that takes the guesswork out of payroll.

With automatic tax table updates, you can be confident that your employees’ withholding calculations comply with US labor laws. Plus, the self-service payroll feature allows you to manage payroll from anywhere, at any time. As a result, you can focus on running your business without worrying about the complexities of payroll.

Reports

Sage 50cloud Accounting offers an outstanding selection of reports that can help you manage your finances and business. The reports cover various topics, including income and expenses, profit and loss, customer and vendor data, inventory levels, and much more.

Sage 50cloud Accounting also makes it easy to customize reports to fit your specific needs. You can choose which data to include, how it should be organized, and even add your graphics and logos. So whether you’re looking for a simple report or a complex analysis, Sage 50cloud Accounting has the tools you need to get the job done.

Pricing:

- Sage Business Cloud Accounting Pro – $33

With Sage pricing, you can get the Pro Plan which includes Making Tax Digital Ready for VAT, managing cash flow, income, and expenses, and setting up professional, personalized invoices and quotes.

The great thing is that you can also track your payments to know exactly where your money is. Plus, with the ability to set up recurring invoices, you can make sure that you never miss a payment again.

- Sage 50cloud Premium – $52

This plan includes features to help businesses manage cash flow, income, expenses, and payments. With the Premium Plan, companies can create & schedule invoices and quotes and apply discounts to invoices automatically. The Sage Premium Plan is an excellent choice for small businesses looking for an all-in-one solution to their accounting needs.

- Sage 50cloud Quantum Accounting – $87

The Professional Plan is ideal for businesses that need to manage their finances more effectively. Companies can create sales and purchase orders with this plan, set up invoices and transactions, and even recurring payments. Additionally, companies can connect with their customers and suppliers through the Sage network, staying up-to-date on their latest offers and discounts.

Product Quality Score: 9 (Excellent)

- Features: 10

- Ease to use: 8

- Pricing: 9

- Customer support: 9

Pros

- Comprehensive reporting tools

- Strong inventory management capability

- Consolidate parent and subsidiary companies

- Offers desktop reliability along with remote access options

Cons

- Difficult for nonprofessional bookkeepers to use

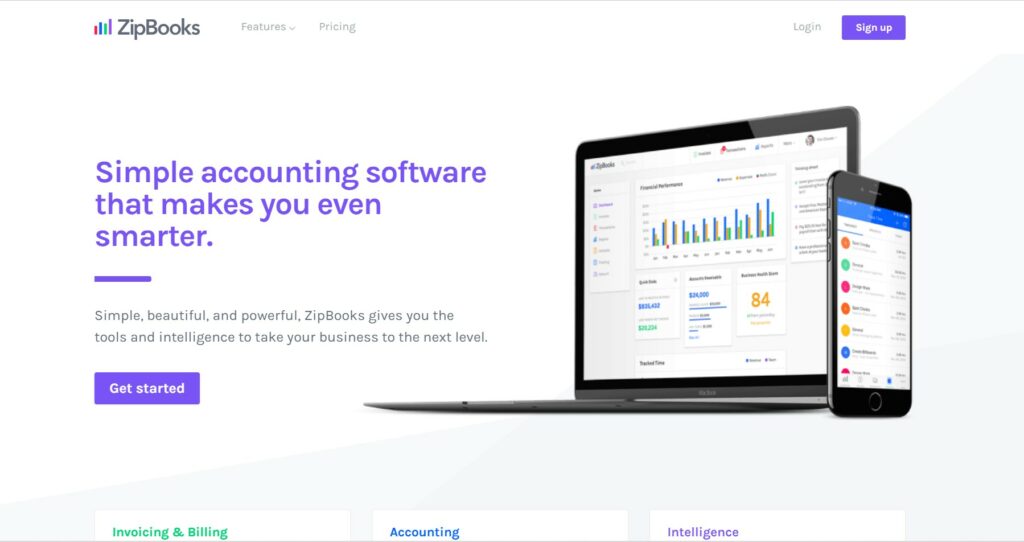

Best for Experienced Accountants: ZipBooks

ZipBooks is a full-featured online accounting software platform that can streamline your small business finances, sales tax collection and payment, payroll expenses, and invoicing in one place without sacrificing quality or features.

The software is designed to help manage your business finances, from tracking expenses and income to preparing tax returns and issuing payments. ZipBooks also offers a range of powerful features for businesses of all sizes, including monitoring inventory levels, creating and tracking customer invoices, processing credit card payments, and generating financial reports. In addition, the software provides a secure environment for storing customer data and keeping your financial information private.

Accounting functionality

ZipBooks’ accounting functionality is a huge time-saver for small business owners. For example, with the ability to link your bank account to the app, you can automatically import transactions and eliminate the need to enter them manually.

This saves you a ton of time, which you can then use to focus on other aspects of your business. Additionally, the accounting features in ZipBooks are very user-friendly and easy to navigate, so you can quickly find what you’re looking for without getting overwhelmed.

Invoicing

ZipBooks makes billing easy with its customizable invoicing feature. You can add your logo and personalize the appearance of your invoices with your choice of color scheme. Moreover, ZipBooks allows you to accept credit card and PayPal payments.

This way, you can get paid faster and have less paperwork to worry about. And if you need to track taxes as payables, ZipBooks can do that.

Reports

ZipBooks offers a good selection of standard reports in a variety of categories. The accounting & tax reports are beneficial. They include standard financial statements, balance sheets, Statements of changes in equity, and tracking reports.

This makes it easy to see where your money is going and to track your progress over time. In addition, each report can be customized to display the specific data users need to see. ZipBooks also offers a handy export feature that allows users to download their data into a CSV file for further analysis.

Pricing:

- Starter – $0

The Starter Plan from ZipBooks is a great way to get started with online invoicing. You can manage an unlimited number of vendors and customers and send unlimited invoices. Plus, you can accept digital payments via Square or PayPal. The Starter Plan also gives you access to basic reports to track your progress. And finally, you can connect one bank account for easy accounting.

- Smarter – $15

With ZipBooks Smarter Plan, business owners can schedule recurring invoices with auto-bill. This feature is great for clients who need to be billed regularly. In addition, ZipBooks will automatically send reminders to business owners when payments are due. This plan also allows business owners to save invoice line items, which is handy for keeping track of expenses.

Furthermore, the Smarter Plan allows business owners to connect multiple bank accounts. This is ideal for businesses with more than one bank account or credit card. With the ZipBooks Smarter Plan, business owners can save time and money by automating their billing process.

- Sophisticated – $35

ZipBooks’ Sophisticated Plan is designed for businesses that need a little extra help staying organized. With smart tagging, you can quickly find the information you need, whether you’re looking for all the transactions for a particular project or want to see all the books for a specific location.

And if you need to customize your categories, our team of experts can work with you to create the perfect chart of accounts for your business. Plus, the reconciliation feature makes it easy to keep track of every account and lock completed books so you can focus on running your business.

- Accountant – Custom

ZipBooks offers a comprehensive accounting solution for businesses of all sizes. The Accountant Plan is designed to meet the needs of accounting professionals who need to track time, generate invoices, and manage financial data. With this plan, businesses can export financial packages, cobrand their firm on client accounts, and track time across client accounts. In addition, the Accountant Plan is an affordable solution for businesses that need a complete accounting solution.

Product Quality Score: 9 (Excellent)

- Features: 8

- Ease to use: 9.5

- Pricing: 10

- Customer support: 8.5

Pros

- Exceptionally good user experience.

- Free version available.

- Task, time, and project tracking

- Ability to accept online payments

- Custom invoicing capability

Cons

- The android app is not available

How Does Accounting Software Work?

Most accounting software programs are designed to automate and streamline the financial record-keeping process for businesses. The core feature of most accounting software is a general ledger, which is used to track all of a business’s financial transactions.

The ledger is divided into different accounts, each representing a different type of transaction, such as income, expenses, assets, liabilities, and equity. When a transaction occurs, it is recorded in the appropriate account.

This information can then generate financial statements, such as income statements and balance sheets. Additionally, many accounting software programs also offer features such as ledgers, bill payments, and payroll processing.

Related: Best Accounting CRM

How Much Does Small Business Accounting Software Cost?

Many small business owners are hesitant to invest in accounting software, thinking it is too expensive or complicated. However, there are several affordable and user-friendly options on the market. The cost of accounting software for small businesses varies depending on the features and complexity of the program. Basic programs can start as low as $10 per month, while more complex ones can cost up to $100 per month.

For example, QuickBooks Online offers a range of features, including invoicing, tracking expenses, and creating financial reports. Prices start at $25 per month for the self-employed plan and go up to $150 per month for the advanced plan.

Xero, another popular option, has plans starting at $9 per month for basic accounting and bookkeeping features. There is also a mid-level plan for $30 per month that includes additional inventory management and project tracking features.

To get an idea of how much accounting software for small businesses would cost your specific needs, it’s best to request quotes from multiple vendors. This way, you can compare prices and find the best value for your money.

Related: Best Free Invoicing Software For Small Businesses

Closing Thoughts

Accounting software is a valuable tool for small businesses. It can help business owners track their income and expenses, manage their finances, and make informed decisions. While there are many different accounting software programs available, it is important to choose one right for your business.

Consider your needs and budget, and take the time to read reviews and compare features before making your final decision. Then, with the right accounting software in place, you will be well on your way to successfully managing your small business finances.