Disclaimer: We sometimes use affiliate links in our content. For more information, visit our Disclaimer Page.

Incremental budgeting is a budgetary planning and control technique that allows organizations to continuously track and manage their financial resources. It involves allocating funds incrementally as they are earned or spent, which helps organizations maintain liquidity and stay within their budget constraints. This article provides an overview of incremental budgeting, including its advantages and disadvantages.

Incremental Budgeting Overview

Incremental budgeting starts with the basic concept that a new budget should be created by making only minor modifications to the existing plan.

In other words, incremental budgeting begins with the current budget and adds or subtracts increments from those amounts to create new spending figures. It is often considered the most conservative approach among all budgeting methods.

Such a budgeting method can be beneficial in several ways. For example, incremental budgeting can be employed when the existing budget has been created using accurate information. But, of course, suppose that budget was based on inaccurate or incomplete data, to begin with. In that case, incremental budgeting is not likely to produce an ideal budget for the upcoming fiscal year.

Incremental Budgeting Process

In an incremental budgeting process, budget changes are based on minor adjustments to the budget. There may be several reasons for budget modification, such as:

- Cost variances and unexpected costs

- New opportunities and initiatives that need funding

- Reduction in funds from other sources, such as grants or donations

In an incremental budgeting process, only the budget line items directly change. These budget changes are tracked using budget revision codes. The budgeting department should define these budget revision codes beforehand and give each code a unique number.

Budget revisions should not be confused with gross expenditures, which can be seen as placing money into an expense bucket before allocating it to any budget line item.

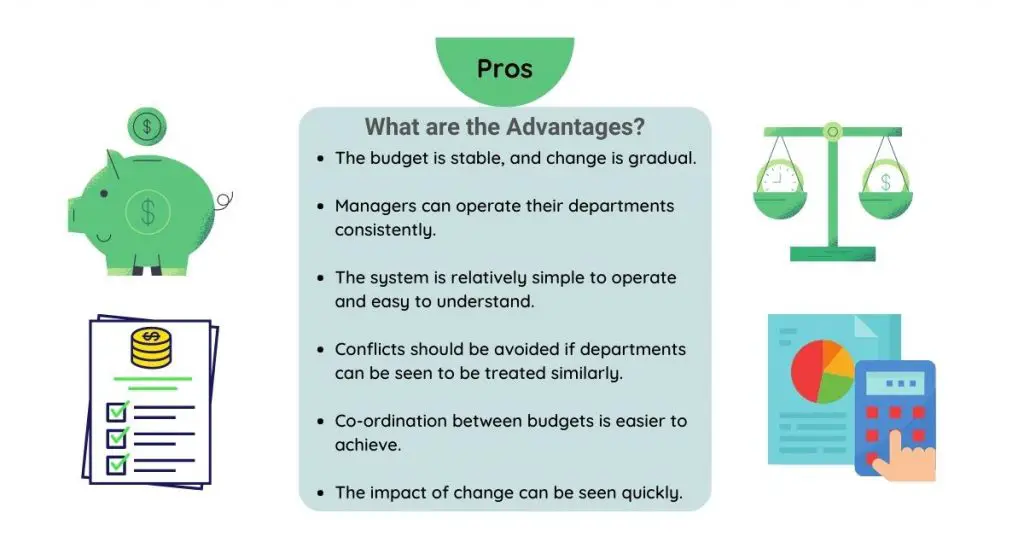

Advantages of Incremental Budgeting

1. Flexibility

With incremental budgeting, budget managers can change or adjust their budget as necessary, provided that the changes fall within specific parameters such as staying under budget for a particular category. This flexibility can help organizations save money and resources and protect budget managers from making irreversible budgeting errors. In addition, the budget manager can make budget changes on a small scale and doesn’t have to worry about budget gaps or reductions affecting the entire budget.

2. Consistency

One of the main goals of budgeting is to maintain consistency across all levels of an organization. As a result, managers can easily link their budget figures with past years and other departments with incremental budgeting.

It’s also possible to budget for future years or quarters by adjusting budget figures as necessary or desired. This consistency helps budget managers avoid the pitfalls of budgeting errors and allows companies to set clear goals and objectives.

3. Visibility

One of the main advantages of a budgetary process is that it provides budget managers with transparency into budget figures. In addition, by using incremental budgeting, budget managers can see the effects of budget changes right away and know where there may be budget gaps or flaws in their budgeting process.

4. Reduces internal rivalry

Budget managers need to avoid budgeting errors and budgeting gaps. But budgeting disputes can be just as damaging to the budget process, especially for organizations with more than one budget manager or department. Incremental budgeting reduces this rivalry because of its focus on making gradual changes rather than sweeping cuts and adjustments.

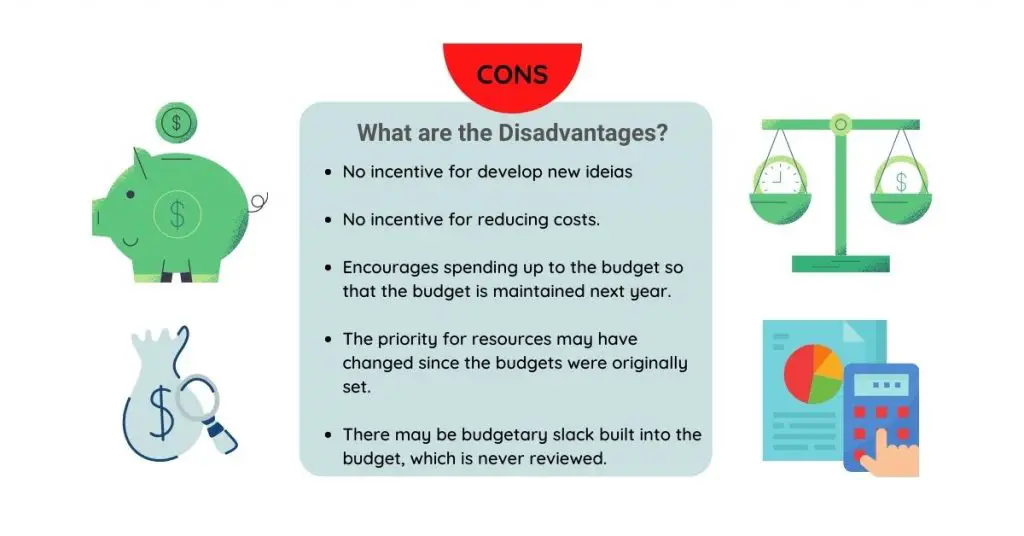

Disadvantages of Incremental Budgeting

As with any budgeting style, there are also some disadvantages associated with incremental budgeting. These include:

1. Promotes unnecessary spending

Incremental budgeting only accounts for increases in budgeted items and does not account for decreases in budgeted items. Therefore, budget funds may be used to pay for unnecessary items when budgeting with an incremental approach.

2. Discourages innovation

When this form of budgeting is used, it might stifle new ideas and development. Because future budgets are based on data from a previous period, there is little room for funding entirely new concepts or activities. As a result, the budgeting process discourages implementing innovative ideas while promoting a backward-looking corporate culture.

3. Difficult to implement

As with many budgeting techniques, specific challenges are associated with implementing incremental budgeting in the company budget. Incremental budgets are not easy to maintain. Budget planning takes a lot of time, effort, and energy if changes are made only incremental.

4. Budgetary slack

Incremental budgeting encourages budget managers to budget less than budgeted items to cover budget gaps and maintain budget flexibility.

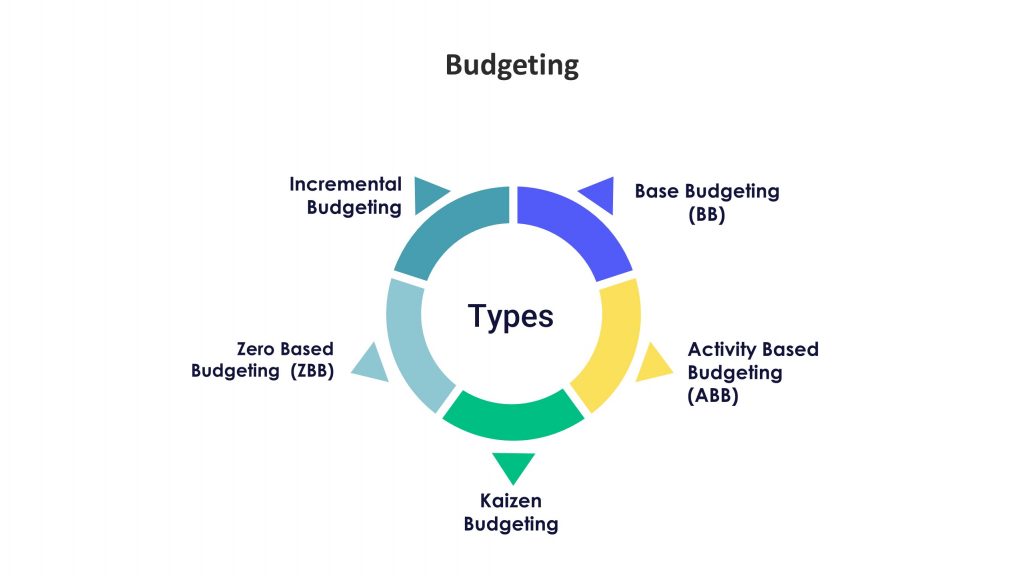

Types of Budgeting methods

There are many types of budgeting methods other than Incremental Budgeting. Let’s take a look at some of the well-known budgeting techniques:

– Zero-based budgeting

This budgeting is the opposite of incremental budgeting. Managers must start from scratch (zero) when revising their budget in this budgeting technique. This allows budgeters to remove any unnecessary budget lines that may no longer be applicable or relevant after the end of the fiscal year. Most companies use at least some elements of zero-based budgeting in developing Flexible budgeting.

With this budgeting, managers can adjust their budget each time they require additional budget money. In addition, this budgeting allows companies to determine an exact amount of budget income and spending at a particular time.

– Base budgeting budgeting

This budgeting method is when budget managers start with pre-determined budget amounts and adjust the budget as needed. This budgeting gives budgeters a helpful framework to make incremental budget changes.

– Actual Performance based budgeting

This budgeting is a combination of zero-based budgeting and incremental budgeting in that budgeters use the previous year’s budget as a base from which to work. This budgeting allows budget managers to begin with their budget from last year and gives them the flexibility to adjust it as needed.

– Kaizen Budgeting method

Kaizen budgeting is a process in which cost reductions are built into the budget on an incremental basis so that continuous efforts are made to reduce costs over a given time.

Other Types vs Incremental Budgeting

Do you want to know the difference between other budgeting and Incremental Budgeting? If yes, read the comparisons below to determine which one is better.

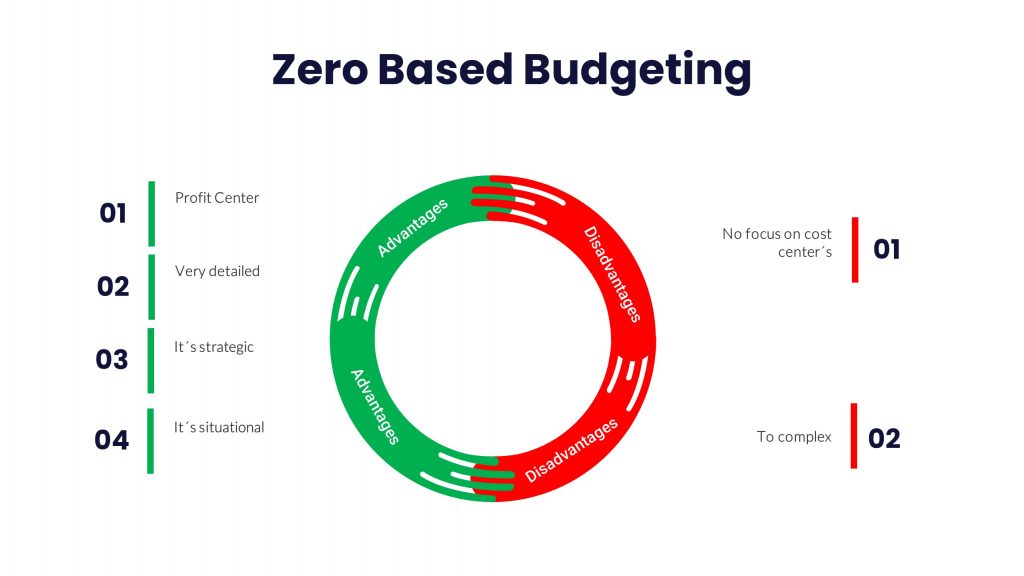

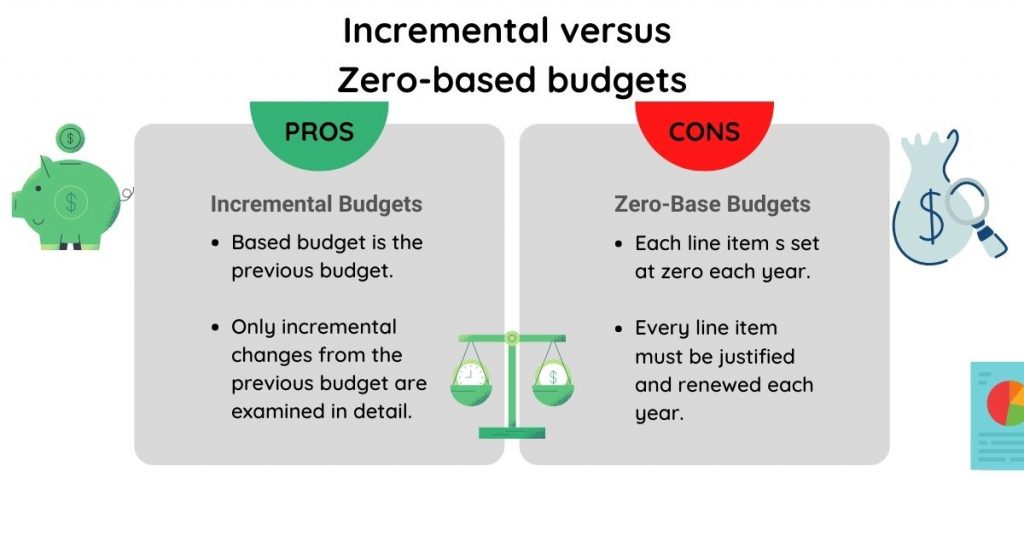

Zero-based budgets vs Incremental Budgets

Zero-based budgeting is the opposite of incremental budgeting. Budget managers must start from scratch (zero) when revising their budget in zero-based budgeting. In contrast, incremental budgeting can only increase or decrease existing budgeted items.

While zero-based budgeting is suitable for companies that want to limit unnecessary spending, incremental budgeting discourages companies from introducing new budget items and increases budgeting difficulties.

Kaizen Budgeting vs Incremental budgeting

Suppose budgeters are struggling with maintaining budget targets. In that case, the incremental budget is the solution since most companies use at least some elements of zero-based budgeting in developing Flexible budgeting.

However, budgeters using Kaizen budgeting is easier since they don’t have to go back to budgeted items at subsequent periods and keep adjusting them.

Conclusion

Incremental budgeting is a strategy for spending minimal money to gain maximum returns. The idea behind this type of budgeting is that it allows you to make small, incremental changes in your marketing and advertising campaigns or operations, which can lead to significant results – all without much risk.

This article has outlined the basics of what incremental budgeting means and its advantages and disadvantages so you can decide if this approach could help improve your business’s bottom line.

If this blog post helped you, please make sure to share it with anyone who wants to learn about Incremental Budgeting. Thanks for reading!

FAQ

What is Incremental Budgeting?

It is a kind of budgeting based on minor changes from the preceding period’s budgeted or actual results. This is a typical technique in firms where management does not desire to spend much time creating budgets or does not feel any pressing need to conduct an extensive company evaluation.

What are budgeting calculators?

Budgeting calculators and budgeting spreadsheets are tools that budgeters use in budgeting. Budget planners can do various tasks with budget calculators or budgeting spreadsheets, such as projecting cash flow, calculating net worth, and much more.

What are things required for budgeting?

To budget, budgeters must understand basic budgeting concepts such as the budgeting equation and how to use budgeting tools like budget calculators or budget spreadsheets. Only a few assumptions are required in the budgeting.