Disclaimer: We sometimes use affiliate links in our content. For more information, visit our Disclaimer Page.

As a small business owner, you have a lot on your plate. It can be tough to find the time to do your taxes between managing your employees, marketing your company, and keeping track of your finances. Luckily, there are tax software programs designed specifically for small businesses.

These programs make it easy to file your taxes quickly and easily without hiring an accountant.

This in-depth guide will explore some of the best tax software for small businesses and help you decide which Software provides the most value!

We’ll also discuss the benefits of each program and provide some tips for choosing the right one for you. So let’s dive right in!

What Is Tax Software?

Tax software is an integral tool for small businesses, as it allows them to keep their tax obligations in order. It also makes it easier to calculate your finances to pay taxes when they are due accurately.

The costs of hiring a tax professional or accountant, who charges by the hour, can prove prohibitively expensive for smaller businesses. Tax software provides a comprehensive and easy-to-use solution that can save business owners both time and money.

Related: QuickBooks Review: Top Features, Pros & Cons

How much does small business tax software cost?

The price of Software for small business taxes depends on the features and complexity of the Software. Basic Software can cost as little as $50, while more complex Software can cost several hundred dollars. Some companies offer free software versions, but these usually have limited features.

5 Best online tax software for small business

We looked at the most popular options and compared them based on price, features, pros, and cons. Here are our top 5 picks for the best online tax software for small businesses.

H&R Block – Overall Best Tax Software

H&R Block offers a comprehensive suite of tax software for small businesses. It is easy to use and helps you file your taxes quickly and accurately. The Software includes all the forms and schedules you need to take advantage of all the deductions and credits available to small businesses. It also offers free support from experts who can help you if you have any questions or need help with your taxes.

Key features:

- Multiple layers of protection

H&R Block provides multiple layers of protection against identity theft and tax fraud. The first layer is the use of encryption technology to protect your data. The second layer is the use of sophisticated anti-fraud measures. But the biggest protection comes from their Accuracy Review. If you e-file your taxes with H&R Block and the IRS finds a mistake, they will reimburse you for any penalties and interest charges you incur.

- Easy W-2 importing

H&R Block makes it easy to import your W-2 information. Enter your employer’s name, and the Software will automatically retrieve your W-2 form. You can then review and correct the information as required. This can help save time and ensure that your tax return is accurate.

- Free in-person audit support

The H&R Block free in-person audit support feature offers taxpayers the opportunity to have their tax returns audited by a professional. This service is available to taxpayers who file their own taxes at no additional cost. This feature can be a valuable resource for small business owners who are uncertain about their tax liability. The H&R Block free in-person audit support feature can help to ensure that your taxes are filed correctly and that you are not overpaying. This service is available by appointment only, so schedule an appointment in advance.

- Auto-import certain tax documents

Automated Import of Certain Tax Documents helps small businesses manage their paperwork. This feature allows companies to automatically import the last ten documents from each vendor, eliminating manual importing. This convenience helps small businesses keep organized and reduce paper clutter. In addition, this feature helps business owners save time by having all relevant documents stored in one place.

- Donation calculator

The Donation calculator is a handy tool that helps users figure out how much they can deduct from their taxable income when making donations to charity. It is easy to use and intuitive, making it an excellent choice for people who want to make the most of their donations. The calculator considers all pertinent information, including the type of donation, the amount donated, and the date of the donation. It then provides users with an estimate of the tax deduction they can expect to receive. The Donation calculator is a great tool for people who want to get the most out of their charitable donations.

- Platform mobility

Platform mobility is an essential feature of any software. By providing a platform that can be accessed from anywhere, businesses can ensure that their employees can work from wherever they are. This not only allows for more flexibility for the employees and enables the company to continue working even if there is a disruption to the normal workplace.

Pricing:

- Free Online plan – $0

The Free Online plan from H&R Block is a great option for simple tax returns. This plan is free to use, and you can file your return online without going to a physical location. You can also access this plan if you are a student, unemployed, or earn income that is not subject to withholding taxes. Additionally, W-2 employees and those with the Child Tax Credit (CTC) may also find this plan helpful.

- Deluxe plan – $39.99

The Deluxe Plan provides integrated HR and benefits administration solutions for growing businesses, all at a significantly reduced cost. The Deluxe plan offers comprehensive premium support services tailored specifically to your organization’s needs. Additionally, Deluxe Plan provides you with access to H&R Block’s world-class online tax filing software.

It provides everything you need to manage your payroll, including tax filing, direct deposit, and online access to pay stubs. Moreover, This Plan allows you to itemize your deductions to maximize your tax savings.

- Premium Plan – $55.99

The H&R Block Premium Plan is a great choice for taxpayers who need help with their complicated tax returns. This plan includes everything in the Deluxe Plan, plus assistance with rental income, investments, and cryptocurrency transactions. With the help of an expert tax preparer, you can be sure that all of your deductions and credits are taken into account. Additionally, you’ll get peace of mind knowing that your return is being handled by a professional. The Premium Plan is the most comprehensive option offered by H&R Block, and it’s perfect for small business owners.

- Self-Employed plan – $87.99

The Self-Employed Plan from H&R Block is designed for taxpayers with self-employment income from a contract or gig work. This comprehensive plan includes asset depreciation, vehicle, home office expenses, and other miscellaneous deductions. Moreover, it offers free one-on-one tax advice from a certified public accountant or enrolled agent with every return.

Pros

- Allows upgrade for on-demand assistance from a tax expert

- You can upload tax documents and track filing status from the mobile app

- Simple step-by-step instructions that are simple to follow

- Unlimited on-demand chat or video support with Online Assist plans

- H&R Block guarantees 100% accuracy or will reimburse you for any penalties or interest up to $10,000.

Cons

- Limited functionality on a mobile app

- Higher tier plans are comparatively expensive

FreeTax USA – Best Free Tax Software

FreeTaxUSA is one of the most affordable tax preparation software programs. It offers expert support for tax situations, making it a favorite among small business owners and budget-minded consumers. The program is easy to use, even for those not experienced in tax preparation. In addition, it offers a variety of features, such as the ability to e-file your return, which makes it an excellent choice for small business owners.

Features:

- Audit Center

The Audit Center is a great feature of FreeTaxUSA that allows you to review your return for potential errors. This can help you avoid costly mistakes and ensure that your return is accurate. The Audit Center also includes information on how to correct any errors found.

- Priority Support

Priority support is an exclusive service offered to FreeTax USA customers who need assistance with their taxes. This service provides you with instant access to tax professionals to get the help you need as quickly as possible. With Priority Support, you can be sure that your questions will be answered promptly and accurately.

- E-File Federal Tax Returns

E-filing is more accurate than paper filing, and it’s much easier to keep track of your return. You’ll receive an email confirmation when the IRS has accepted your return, and you can track its status online. Plus, you can resubmit it electronically if you need to make any changes to your return after filing it.

- Estimated Tax Return

FreeTaxUSA’s Estimated Tax Return is an essential tool for small business owners. This feature allows you to estimate your tax liability and make payments throughout the year, so you don’t have to worry about a big bill when it comes time to file your taxes. The Estimated Tax Return is also handy for tracking your progress and ensuring you are on track to meet your tax obligations.

- Tax Extension Filing feature

The FreeTax USA Tax Extension Filing feature is a free service that allows business owners and self-employed individuals to fill out their tax extension forms. Once you sign in, you can start selecting your state from the dropdown menu before continuing with the online filing process. The process is simple and can be completed in minutes. Just enter your basic information, such as your name and address, and select the extension type you need. After that, you’ll just need to provide some basic financial information so we can calculate your estimated taxes owed. Finally, review everything for accuracy and submit your form.

Pricing:

- Free Edition ($12.95 for state returns)

The FreeTaxUSA Free Edition can help your business stay compliant with IRS regulations. The Software is free and supports all primary tax forms, including Form 1040, investment income, rental property income, and homeownership information. In addition, you can file with the Free Edition if you’re self-employed or have a different filing status. It includes features like automatic donation transfers and the ability to back up your tax return. You can also file your taxes online or mail with the Free Edition.

- Deluxe Edition $6.99

The Deluxe Edition is perfect for businesses with more complex taxes. It includes all the features of the Free Edition, plus unlimited amended returns, audit support, live chat, and additional support. In addition, it offers free federal filing while the state return costs $12.95/state.

Pros

- Excellent mobile website experience

- Affordable pricing

- Free federal filing

- Supports all major forms and schedules

- Good context-sensitive help

Cons

- Not many additional features

- Can’t import W-2s or 1099s

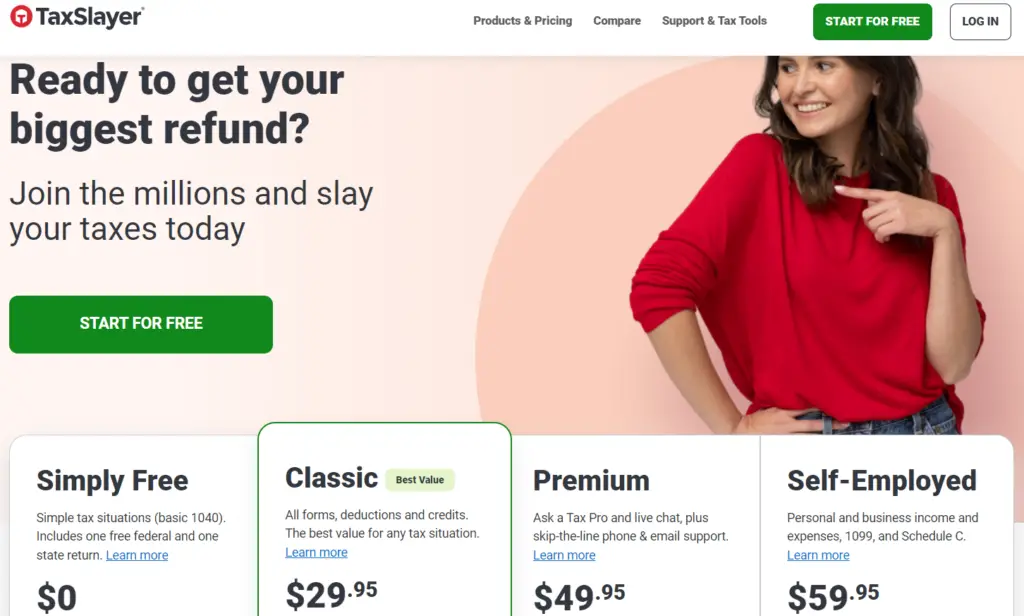

Tax Slayer – Best for Self-Employed

Tax Slayer is a multiplatform solution designed to streamline your tax management and save your time. It makes it easy to file your taxes, with a user-friendly interface and helpful wizards that guide you through the process. In addition, tax Slayer is accurate and up-to-date, with all the latest changes to the tax code. It also includes free support from a team of experts to be confident that your taxes are done right.

Features:

- Deduction Finder

This feature makes it easy to get the most money back from the IRS. The Software searches through all of the deductions and credits available, ensuring taxpayers get the biggest return possible. Deduction Finder is just one of the many features that make Tax Slayer the best tax software for small businesses. With Deduction Finder, companies can maximize their deductions and get the most refunds.

- Import Prior Year Tax Info

Importing your prior-year tax information into Tax Slayer is a breeze. The Software will automatically fill in most of the information for you, so all you have to do is verify that it’s correct and hit submit. This will save you time and ensure that your return is filed accurately. Plus, the import feature is compatible with various tax software, so you can be sure that your information will be imported correctly.

- IRS Audit Assistance feature:

IRS Audit Assistance is an invaluable feature for individuals and small business owners. It allows you to keep everything organized and compliant while also providing training and support. IRS Audit Assistance helps protect your company from an audit by using a question-and-answer-based tool to ensure that all records are kept up with.

- Email & Phone Support

The Software is fully integrated to allow you the most convenience and flexibility in how your business processes information. Incorporating email encryption, cloud databases with data protection technologies designed for performance, and a work order management system that eliminates unnecessary steps or paperwork, you’re running an efficient operation from day one.

The Software also features phone integration to allow you to quickly and easily communicate with clients from within the Software. This will enable you to manage your client relationships more effectively and efficiently. With this feature, you can also ensure that your employees are always up-to-date on the latest customer service procedures.

Pricing:

- Simply Free

The free plan is perfect for simple tax situations, like filing a basic 1040. With this plan, you can file one federal and one state return for free. The Software is easy to use, and you can get started right away.

- Classic – $29.95

The Classic pricing plan is the best value for any small business. It includes all forms, deductions, and credits to help you get the biggest tax refund possible. You can also file your return online with ease. You’ll get step-by-step instructions and support every step of the way.

- Premium – $49.95

The Premium plan of Tax Slayer offers several features that make preparing and filing your taxes easier. With this plan, you can access Ask a Tax Pro, which gives you live chat support from an expert tax preparer. You also can skip the line and call or email support for help. In addition, this plan includes helpful features like a tax return checklist and priority processing.

- Self-Employed – $59.95

The Self-employed plan includes personal and business income and expenses and 1099 and Schedule C reporting. This straightforward tax app stores your receipts within your virtual filing cabinet and then imports them right before you file onto the most up-to-date version of official IRS forms, so you don’t have to worry about which version you should be using.

Pros

- Impressive design and User-friendly interface

- Affordable

- More contextual help than before

- Supports all primary IRS forms and schedules

Cons

- Too much reliance on IRS instructions and publications

TaxAct – Best for Beginners

TaxAct is a leading affordable digital tax preparation and filing software provider for individuals, families, and small businesses. With TaxAct, you can prepare and file your taxes quickly and easily online without hiring an accountant.

TaxAct’s intuitive interface makes it easy to navigate, and its step-by-step instructions walk you through the filing process to be confident that your taxes are done right. In addition to its easy-to-use Software, TaxAct offers many other advantages for small businesses. For example, TaxAct provides free audit support and representation from a tax professional if the IRS audits you. This can save you a lot of time and money, and stress.

Features:

- Expanded W-2 Import

TaxAct’s Expanded W-2 Import allows you to quickly and easily import your W-2 data directly from your designated W-2 provider. This feature saves you the time it would take to manually key in all of your information to get started on your taxes sooner.

- Improved Sign-in Experience

The sign-in process for TaxAct has been revamped. This means that filers will experience a smoother sign-in process, allowing them to get back into their return and view their tax data faster. The new design is sleek and easy to navigate, making it simple for filers to pick up where they left off on their return. Plus, the new process will make it easier for filers to access their prior year’s return to get a head start on their taxes this year.

- Access to Prior-year Return feature

It lets you view and print your tax returns for the past three years. This can be helpful if you need to review your return or prepare to file an amended return. You can also use this feature to help with tax planning for the upcoming year.

To access your prior-year return, log in to your account and the “My Account” tab. From there, click on the “Returns & Documents” link. Under the “Other Tax Returns” heading, you will see a link for “View and print prior-year tax returns.” Click on that link, and you will be able to view and print your return.

Pricing:

- Free

The TaxAct free plan is perfect for simple tax filings. You can use it for filing taxes completely free, and you don’t need to have any dependents or unemployment income to qualify. The free plan includes all of the basic features, such as online filing and IRS e-file, to quickly complete your return without leaving your home.

- Deluxe – $46.95

The TaxAct Deluxe edition is designed for homeowners, childcare providers, and recipients of student loan payments. The TaxAct Deluxe edition can handle four federal schedules (1040EZ, 1040A, 1040, and 1065) and three Colorado supplemental schedules (719-DIV/INTXFMT, 720-LEVEL1GAMECAP, and 720-TOOLBOX), and one Illinois tax schedule (IL-4400). The TaxAct Deluxe edition is also the only version that offers a free audit defense service. This service provides you with access to a team of auditors who will help you if the IRS audits your return.

- Premier – $69.95

The TaxAct Premier plan is a comprehensive tax preparation solution for small business owners and independent contractors. It offers all the features and benefits of the Deluxe plan, plus additional support for investments, sales of a home, and rental property. In addition, the Premier plan provides everything you need to complete your taxes quickly and accurately, including step-by-step instructions, checklists, and expert help from a TaxAct tax professional.

- Self Employed – $94.95

The TaxAct Self-Employed plan is perfect for freelancers, contractors, and business owners. It offers all the features of the Premier plan and additional tools to help with estimated taxes and Schedule C paperwork. With the Self-Employed plan, you’ll get:

- A comprehensive tax return with all the forms and schedules you need

- Tools to help estimate your taxes and file your quarterly estimated tax payments

- Deduction Finder to maximize your business deductions

- Support from a TaxAct Professional if you need help or have a question

Pros

- Free tax-related help through Xpert Assist

- Voluminous help content in the Answer Center’Logical organization of tax topics

- Great user experience

Cons

- Expensive per-state filing

- Search results are not always targeted

Intuit TurboTax – Best for Partnerships and Corporations

Intuit TurboTax is an all-in-one tax software solution. It makes it easy to file your taxes, whether you are doing them yourself or have them prepared by a professional. The Software is easy to use and can help you find valuable tax deductions and credits for which you may be eligible. You can also file your taxes electronically with TurboTax, which can be time-saving.

Features:

- Payroll & Employer Forms feature

Intuit TurboTax allows business owners to easily complete and file federal and state payroll tax forms and W-2 and 1099 forms. Additionally, the feature helps employers stay compliant with labor laws, including minimum wage and overtime regulations.

- Data Import/Export

Intuit TurboTax features easy data import and export capabilities, so you can seamlessly move your data in and out of the Software as needed. This allows you to easily keep your records up-to-date, important for tax preparation purposes. You can also use the data import feature to quickly bring your information into TurboTax from other tax software programs you may be using (liberty tax, etc.) This makes the transition to TurboTax straightforward, so you can get your taxes done quickly and easily.

- Tax Calculation feature

Intuit TurboTax’s Tax Calculation ensures that your taxes are done accurately and efficiently. It walks you through each step of the tax filing process, asking questions to make sure that you are claiming all of the deductions and credits to which you are entitled. In addition, it compares your information with that of last year’s return to help you get the most accurate refund possible.

- Reporting & Statistics

Reporting and statistics help you track your tax return information with ease. For example, you can see how your taxes are shaping up as soon as they’re done filing and get an instant snapshot of what’s due or refunded at any time by checking the box for “creditors, income agent etc., then clicking on Report + Statistics in the upper right-hand corner; this will open the report in a new window.” You can also compare your current year’s taxes to past years by selecting the year you want to view from the “Compare To” dropdown menu in the new window.

- Customizable Reports

TurboTax lets you customize your reports to see the most important information to you. For example, you can filter by category, date range, etc. This gives you a clear picture of how your business is doing and where you may need to make adjustments. Furthermore, you can view your report as a table or graph. This makes it easy to spot trends and see where your business is improving or falling behind.

- Crypto support

Intuit TurboTax software has Crypto Support, which seamlessly handles digital currencies’ tax compliance and reporting requirements. This includes full support for Form 8949, which reports capital gains and losses from cryptocurrency transactions. With TurboTax, you can confidently handle your crypto taxes correctly and efficiently. This support is available for both state and federal taxes.

Pricing

- Free Edition – $0

The Free Edition is free for federal and state filing. You only pay when you need to file additional forms or schedules. It features easy to prep, print, and e-file capabilities and a jumpstart on your taxes by snapping a photo of your W-02. You can also get help from TurboTax experts.

- Deluxe – $59

TurboTax Deluxe maximizes mortgage and property tax deductions, turning donations into significant deductions, and searches 350+ tax deductions and credits. This makes it ideal for small business owners who want to get their taxes done smoothly and efficiently.

While Deluxe is a great choice for small business owners, it’s important to note that it doesn’t offer the same level of support as TurboTax Premier or Self-Employed. If you need technical help with your taxes, you’ll want to choose one of those options.

- Premier – $89

Intuit’s TurboTax Premier is a comprehensive solution for those with investment and rental property income and cryptocurrency transactions to report. It will automatically import your investment income data, help you accurately account for gains and losses from cryptocurrency transactions, and take advantage of all rental property tax deductions.

- Self-Employed plan – $119

The Self-Employed plan from TurboTax is perfect for independent contractors, freelancers, and small business owners. It features guidance for those in those industries and uncovering industry-specific deductions that can lead to more tax breaks. It’s easy to upload your 1099-NEC form with a snap from your smartphone, and you’ll also get one-on-one help from self-employment tax specialists.

Pros

- Outstanding user experience

- Covers tax topics in exceptional depth

- Excellent help resources and virtual support options

- Personalized explanations of tax calculations

Cons

- There are additional charges for live expert assistance plans.

- Mobile apps lack functionality

Related: Best Free Bookkeeping Software for Small Business

Final Thoughts

Tax software makes preparing and filing your taxes a breeze. Whether online tax software or desktop software, the process is simple. In addition to the convenience of having all of your paperwork in one place, most tax software programs walk you through every step of the filing process, making it easy for even first-time filers to complete their taxes with confidence.

If you are a small business owner, several tax software programs are specifically designed to meet your needs. These programs offer features such as the ability to track expenses and generate reports, making it easy to stay on top of your finances and ensure that you are taking advantage of all of the deductions and credits available.