Disclaimer: We sometimes use affiliate links in our content. For more information, visit our Disclaimer Page.

If you’re looking for a comprehensive guide to horizontal analysis, you’ve come to the right place. This blog post will discuss what horizontal analysis is, why it’s important, and how to perform it correctly.

Horizontal analysis is one of the most fundamental financial analyses that you can perform. It allows you to compare different data sets over a specific period to identify trends and patterns.

By understanding how your company performs over time, you can make more informed decisions about allocating your resources.

Let’s get started!

What is Horizontal Analysis?

Horizontal Analysis in Reporting Standards The Generally Accepted Accounting Principles (GAAP) define a financial analysis approach that lets you compare different data sets over a given accounting period to spot trends and patterns. Horizontal analysis is one of the most fundamental analyses of historical financial information that you can perform.

It helps you understand how your company is performing over time to make more informed decisions about allocating your resources. By comparing data sets side-by-side, you can identify upward or downward trends in revenue, expenses, and net sales. This information can be used to make strategic decisions about pricing, budgeting, and product development.

How Horizontal Analysis Works?

Analysis on the horizontal level allows investors and analysts to examine a firm’s performance over several years and identify trends and growth patterns. This sort of study permits analysts to observe changes in various line items over time and project them into the future. To perform horizontal analysis, you will need to gather financial data for your company over a specific period. This data can be pulled from your company’s financial statements, such as the balance sheet, income statement, and cash flow statement.

Once you have this data, you can begin to compare it side-by-side. For example, you can compare your company’s revenue from last year to this year or your company’s net income from last year to this year. You can also compare specific expenses, such as marketing expenses or wages and salaries. By comparing data sets in this way, you can identify trends and patterns in your business performance.

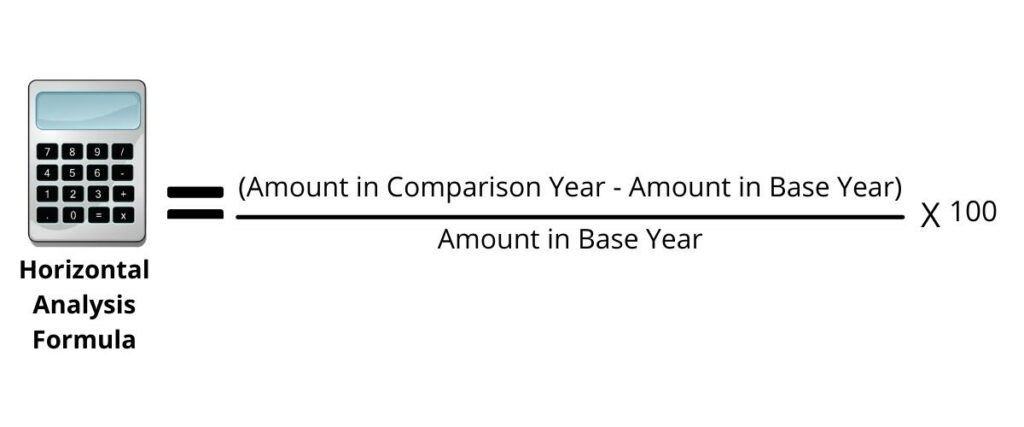

Horizontal Analysis Formula

It is used to compare two different years by taking the difference of the amounts in each year and dividing it by the amount in the base year. This formula is then multiplied by 100 to get the percentage difference. This can be used to compare different aspects of a company, such as sales, profits, and expenses.

The Horizontal Analysis Formula is a very useful tool for comparing different years and understanding how a company is performing. By using this formula, businesses can identify areas where they need to make changes to improve their performance.

Horizontal Analysis vs. Vertical Analysis

Now that we’ve discussed what horizontal analysis is and how it works let’s take a moment to discuss the difference between horizontal analysis and vertical analysis. These financial analysis techniques compare different data sets over time, but they differ in how the data is presented.

In horizontal analysis, the data sets are presented side-by-side. This makes it easy to see how your company performs over time and identify trends or patterns. In vertical analysis, the data sets are presented about each other. For example, you might compare a company’s revenue from last year to its revenue from this year or its net income from last year to its net income from this year.

Vertical analysis is most helpful in examining changes in percentages. For example, you can use vertical analysis to compare a company’s net income from last year to its net income from this year as a percentage of revenue. This information can help you identify whether or not your company is becoming more or less profitable over time.

While horizontal and vertical analysis both have their uses, horizontal analysis is generally more popular because it is easier to understand and visualize. In addition, it allows you to see how your company is performing overall and how individual line items are changing over time.

What is financial statement analysis?

Financial statement analysis is the process of examining a company’s financial statements to assess its financial health and performance. It includes the balance sheet, income statement, and cash flow information.

Financial statement analysis can be used to evaluate a company’s liquidity, solvency, profitability, and overall financial position. It can also identify trends in revenue, expenses, and net income. Analyzing a company’s financial statements investors and comparing company performance with other companies in the same industry helps analysts to make informed decisions about whether or not to invest in the company.

How to perform the horizontal analysis?

Steps to perform a horizontal analysis:

- Choose an item, account balance, or ratio to analyze.

- Choose a starting year and compare the dollar and percentage change to later years against the base year.

- To calculate percent change, first, divide the dollar difference between the two years by the line item value in the base year, then multiply the quotient by 100.

To make horizontal analysis even more helpful, you can project future performance. This can be done by extrapolating data from the past and applying it to future periods. For example, suppose your company’s financial performance has increased steadily over the past few years. In that case, you can use this data to predict how much revenue your company will generate in the future.

Example of Horizontal analysis

The following is an example of Horizontal analysis by Investopedia.

As the name implies, horizontal analysis shows changes from the baseline period in the dollar and percentage terms. For example, a statement claiming that revenues have risen by 10% this quarter is based on horizontal analysis.

The percentage change is determined by dividing the dollar difference between the comparison year and the base year by the line item value in the base year, then multiplying the result by 100.

Assume an investor decides to invest in company XYZ. The investor may desire to understand how the firm has altered over time to decide. For example, if that Company XYZ’s net income was $10 million and retained earnings were $50 million at the start of its existence, as depicted by example.

In the current year, firm XYZ earned a net income of $20 million and retained earnings of $52 million. As a result, its net income has increased by $10 million and its retained earnings by $2 million years over year. As a result, company ABC’s net income shot up by 100 percent year over year ($20 million – $10 million) / $10 million * 100), whereas its retained earnings only rose by 4 percent (($52 million – $50 million) / $50 million * 100).

Final thoughts

Horizontal analysis is a great way to examine past performance and identify growth and profitability trends. However, always use caution when applying historical data to future periods. Many factors can affect business performance, and it’s impossible to predict the future with 100% accuracy.

If you’re looking to invest in a company, horizontal analysis can be a helpful tool in your decision-making process. Understanding how the company has changed over time can better comprehend its potential future performance. However, always consider other factors, as no single tool can give you a perfect prediction of what will happen in the future.

Thanks for Reading!