Disclaimer: We sometimes use affiliate links in our content. For more information, visit our Disclaimer Page.

You might have a profitable business in mind, but here comes the problem: You don’t have enough funds to make it happen. Obtaining a business loan is one of the solutions to increase your capital.

Keep in mind, though, that a credit application poses several requirements for borrowers, and that includes a good credit history. A poor credit rating is unfavorable in getting approved for a loan, but yes, it is possible. We have gathered practical ways for individuals to get a business loan with bad credit. Read on to find out the answers.

6 Practical Ways to Get a Business Loan with Bad Credit

Although some creditors prefer to approve borrowers with higher credit scores, some companies lend money to startup businesses and borrowers with low credit ratings. Here are the easy ways to get a business loan approval.

1. Evaluate Your Purpose

Before applying for a loan, you must consider your purpose and goal. Ask yourself: Does my business need additional funding? Will this increase its efficiency, production, and revenue? Are there other solutions to continue the operation and expand the business without financing? Can I raise funds through different approaches that do not incur interest, like stock offering or crowdsourcing?

Loans can help grow your business. But if you are still starting out and already have a low credit rating, you might want to think twice before sending your loan application.

2. Assess Your Credit Standing

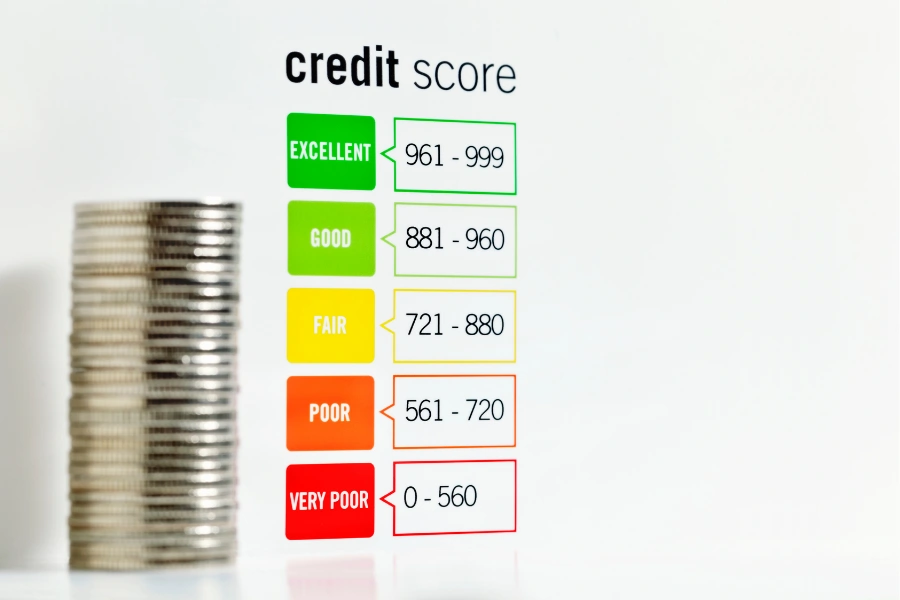

Before applying for a business loan, assess your personal and business credit scores. Other creditors accept borrowers with credit scores falling as low as 530 but give more favorable terms to those whose scores are higher than 600.

If you have a bad credit history, be careful of companies that run hard inquiries on your account, as it would negatively affect your credit rating.

3. Consider Offering Collateral or Adding a Co-signer

A collateral agreement is one of the best methods to reduce the risk of losses on the creditor’s part. Some common forms of collateral are legitimate investment accounts, savings accounts, and other personal assets such as fully paid cars and real estate properties.

However, offering collateral can be risky. For example, you might lose valuable possessions like your car or even your home. So, decide whether the personal assets you provide as collateral are those you can afford to lose. If not, avoid this option altogether.

Another way to increase the chances of your business loan approval is by adding a co-signer. A co-signer with a good credit score and the means to cover the costs will be partially responsible for paying off your loan. But make sure to discuss the terms with your co-signer and that both parties agree to these terms to avoid future disputes.

4. Compare Different Loan Companies

Different creditors impose different terms and conditions, too. So when you have a bad credit score, look for creditors that do not have strict requirements for loan applicants.

Legitimate online lenders such as the available online payday loans Mississippi has are one of the best options for a business loan if you have a bad credit history. They usually approve applications with low credit scores. Also, the application process is faster. If you have a few companies in mind, check their interest rates, loan terms, and the minimum and maximum loan amounts you can borrow.

5. Prepare Requirements for Business Loan

Unlike personal loans, business loans require additional documentary requirements such as tax returns and financial records. These documents are crucial for lenders to assess your eligibility and the legitimacy of your business.

Some creditors might require you to show your comprehensive business plan. For example, include revenue projections to show your potential profit in the next few years, especially if your business is new and doesn’t have a solid financial report yet.

6. Send Your Business Loan Application

Once you’ve gathered all the documents, requirements, and business plans needed for your loan application, sign all the necessary papers and proceed to the next step. Other companies want in-person submission of all the requirements, but others prefer that borrowers send them online. Ask the lender to know which option they require.

How to Boost Your Credit Score for Business Loans

Improving your credit score is a crucial step in securing a business loan, especially if your current rating isn’t ideal. A higher credit score not only increases your chances of loan approval but can also fetch better terms. Here are practical strategies to elevate your credit score:

- Prioritize Timely Payments: Consistently paying your bills on time is essential. Set reminders or alarms a few days before due dates, and if possible, opt for automatic online payments. This habitual punctuality will positively reflect on your credit score.

- Reduce Existing Debt: Aim to pay off existing debts before applying for a new loan. A high level of outstanding debt can significantly drag down your credit score. Prioritizing debt reduction can improve your financial standing and creditworthiness.

- Limit Loan Applications: Avoid applying for multiple loans simultaneously. Each application often involves a hard credit inquiry, which can temporarily lower your credit score. Too many inquiries in a short period can raise red flags for lenders.

- Separate Personal and Business Finances: Maintain distinct financial records for personal and business purposes. Having separate bank accounts ensures that your personal financial behavior does not impact your business credit rating, and vice versa.

- Incorporate Reliable Business Partners: Adding credible business partners can bolster your business credit rating, especially if they have strong credit histories. They can also serve as co-signers for future business loans, providing additional financial stability and reassurance to lenders.

- Regularly Monitor Your Credit Reports: Frequently review your credit reports for errors or inconsistencies. Discrepancies can negatively affect your credit score. If you find any errors, dispute them promptly with the credit bureaus. Accurate credit reports are crucial for a fair assessment of your creditworthiness.

- Utilize Credit Wisely: Be judicious in how you use your available credit. It’s advisable to use less than 30% of your credit limit. High utilization rates can be a red flag to creditors, indicating potential financial stress or mismanagement.

- Establish a Mix of Credit: Having a mix of different types of credit (like revolving credit and installment loans) can positively impact your credit score. It demonstrates your ability to manage various forms of credit responsibly.

- Avoid Closing Old Credit Accounts: Older credit accounts contribute positively to your credit history. Closing them can shorten your credit history and potentially lower your credit score. Unless there’s a compelling reason, such as high fees, it’s often better to keep them open.

- Seek Professional Advice: If you’re struggling to improve your credit score, consider consulting with a financial advisor. They can provide personalized strategies based on your specific financial situation and goals.

By implementing these strategies, you can work towards improving your credit score, enhancing your eligibility for a business loan, and securing better loan terms. Remember, building a good credit score is a gradual process, but it’s a critical aspect of your financial health, especially when it comes to business financing.

You Can Get a Business Loan Regardless of Your Credit Score

Although a business loan increases your business funds and could help bring in huge profits in the future, considering a few things before sending your loan application is crucial. First, build your credit rating through timely payments, avoid unnecessary debts, work with reliable business partners, and separate your business funding from your personal finances.

Finally, before acquiring a business loan, assess various offers from different creditors and prepare a well-written business plan to increase your chances of getting approved regardless of your credit score.