Disclaimer: We sometimes use affiliate links in our content. For more information, visit our Disclaimer Page.

Businesses need money to operate, and a business line of credit can be a great way to get the cash you need. A business line of credit is a loan extended to businesses and can be used for any purpose. This type of loan differs from a traditional one because it does not have to be used for a specific purpose. It can cover operating expenses, expand your business, or purchase inventory.

This article will discuss the six best business lines of credit and how they can benefit your business. The following is a quick go-through of our list if you’re in a hurry.

What Is a Business Line of Credit?

A business line of credit allows you access to cash whenever you need it and is a highly flexible financing option. You don’t need to borrow funds from your credit line if you don’t need them. You even only pay interest on the amount you borrow.

Small business loans allow you to keep ownership, profits, and control over your business. Instead of selling equity, revolving lines of credit will enable you to increase your cash flow as you repay them. If your business grows and needs money quickly, a business line of credit is the perfect financing tool.

There are no restrictions on how you can use a business line of credit, so you can use it to cover any costs or opportunities you face as you continue your business. You can also use it as a rainy day fund or cover any cash flow gaps during seasonal slumps.

Exploring Local Financial Solutions for Business Needs

While we’re about to delve into some of the best business lines of credit available on a broader scale, it’s essential to remember the value of local financial institutions in supporting businesses.

Many businesses have found immense value in partnering with a local credit union, which often offers personalized services, competitive rates, and a deep understanding of the local business landscape. These institutions can provide a more tailored approach to your financial needs, ensuring that you get the best possible support for your unique business challenges.

6 best business line of credit

Following are some of the best business lines of credit.

1. Kabbage – Line of credit

Kabbage is a financial technology company that provides loans and lines of credit to small businesses. For businesses with fair credit and who need quick access to working capital, Kabbage loans are a good option. In addition to offering credit lines up to $250,000, Kabbage also offers monthly repayment options.

It uses various data sources, such as a business’s online sales, to determine its creditworthiness and offer to finance. This can be useful for companies that may not have access to traditional forms of credit, such as a small business with no credit history or one that a bank has rejected for a loan. Kabbage can help enterprises to access the capital they need to grow and succeed by offering alternative financing options.

Key features:

- Quick and easy application process: Business owners can apply online and receive a decision in minutes, allowing them to quickly access the capital they need.

- Flexible repayment terms: Offers flexible repayment terms, with monthly payments automatically deducted from the business’s bank account.

- High credit limits: Offers credit lines up to $250,000, giving small businesses access to the capital they need to grow and succeed.

- Multiple data sources: Uses various data sources, such as a business’s online sales and shipping data, to determine its creditworthiness and offer to finance.

- Ongoing access to capital: If a business is approved for a Kabbage loan or line of credit, it can continue to access additional money as needed without having to reapply.

- A minimal amount of documentation is required for the application process.

- There is funding available within a few days for up to $250,000.

- Borrowers with 640 or higher credit scores are accepted.

- Repayment schedules every month (instead of daily or weekly).

- Fees for account maintenance or withdrawals are not charged for prepayments.

- You must have an online checking or PayPal account for cash flow verification.

- You must provide a personal guarantee.

- Comparing costs with other lenders is difficult due to the complex monthly fee structure.

- Business credit cannot be built with this card.

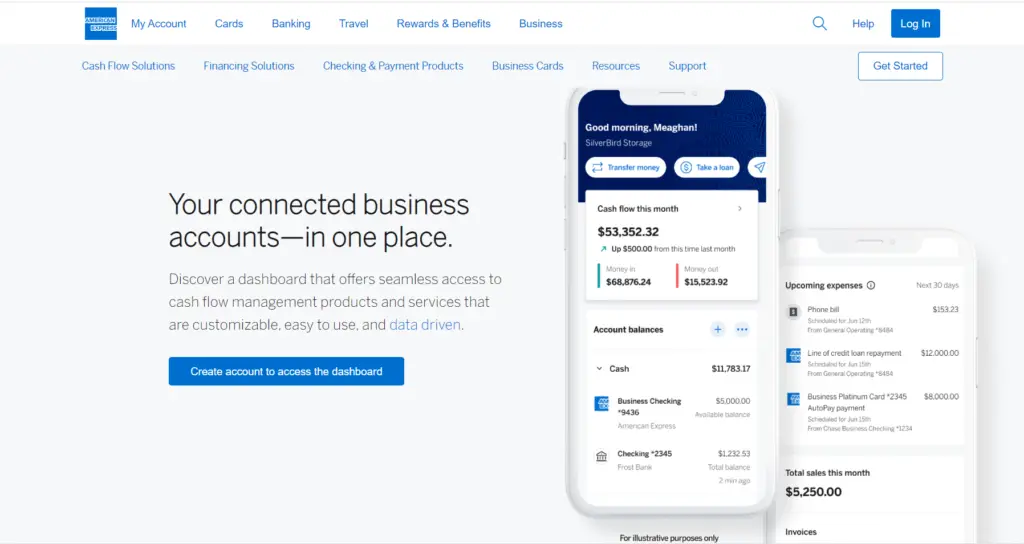

2. PNC Bank – Line of credit

PNC Bank is a financial institution that offers a range of banking and financial services to individuals and businesses. PNC offers a business line of credit that can provide businesses with quick access to working capital to help them manage their cash flow and grow.

The line of credit is a flexible financing option that allows businesses to borrow money as needed, up to their credit limit, and then repay the borrowed amount, plus interest, every month. To qualify for a PNC business line of credit, businesses typically need excellent credit and multiple years of operating history. They offer credit limits of up to $100,000, which can be funded as quickly as the same business day.

Key features:

- A range of financial products and services: The bank offers checking and savings accounts, credit cards, loans, and online and mobile banking tools for businesses.

- Multiple locations: Businesses can access their accounts and manage their money with branches and ATMs throughout the country.

- A business line of credit: Offers a business line of credit that provides businesses with quick access to working capital to help them manage their cash flow and grow.

- Quick funding: PNC’s business line of credit can be funded as quickly as the same business day, allowing businesses to quickly access the capital they need.

- High credit limits: Providing businesses with access to capital for growth and success, its business line offers credit limits of up to $100,000.

- The competitive interest rate on a bank line of credit.

- Funding can be provided on the same day.

- Repayments are made every month without a set term.

- Business experience and a high minimum credit score are required.

- The borrower must provide a personal guarantee.

- Specific industries and states are not eligible.

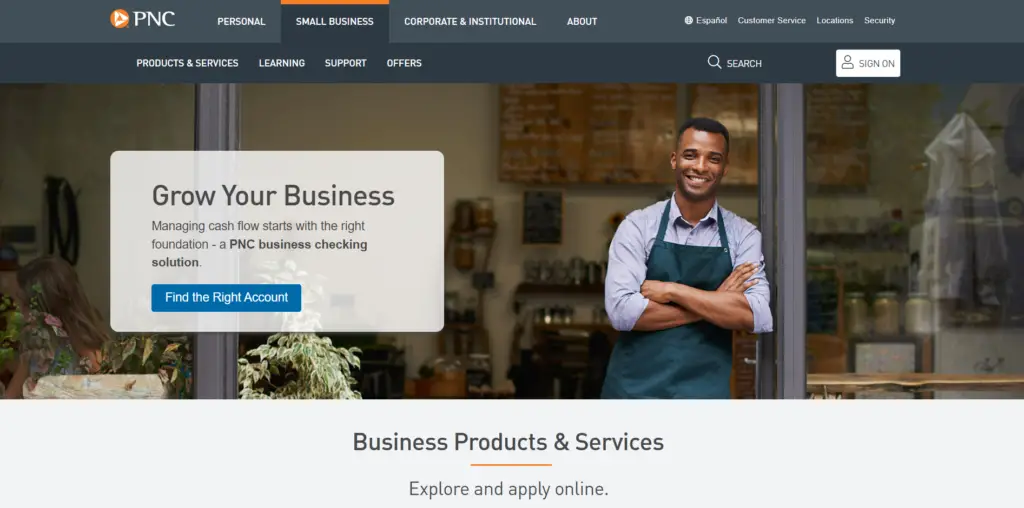

3. Fundbox – Line of credit

With Fundbox, businesses can get a line of credit and invoice financing. Its business line of credit is designed to fill a cash-flow gap, and qualifying is more straightforward than with other lenders. Businesses with credit scores of 600 or higher can receive quick funding of up to $150,000 from Fundbox.

It can help businesses by providing access to working capital that they can use to fund their operations and grow their business. For example, if a company has outstanding invoices that they have not yet been paid for, they can use Fundbox to get a cash advance on those invoices to have the funds they need to pay their bills and employees. This can be a helpful solution for businesses that need short-term financing or have trouble accessing traditional forms of credit.

Key features:

- Cash Flow Management Made Easier: You can eliminate cash flow gaps in your business by clearing invoices immediately using Fundbox.

- Get Advance Payments: Instead of waiting for your clients or customers to pay, you can collect advance payments.

- Fast and Easy Registration Process: You can register in less than thirty seconds. No documents need to be submitted.

- Reliable Platform: A significant number of businesses and industry experts trust Fundbox. This shows its effectiveness.

- The financing can be obtained within one business day of approval.

- Documentation is minimal for this simple application.

- It accepts borrowers who have been in business for at least six months.

- The minimum credit score is low.

- Inactivity fees, account maintenance fees, or prepayment penalties are not charged.

- The rates are higher than those offered by traditional banks.

- There may be a requirement for a personal guarantee.

- It cannot be used to build business credit.

- The repayment period is short (maximum 24 weeks).

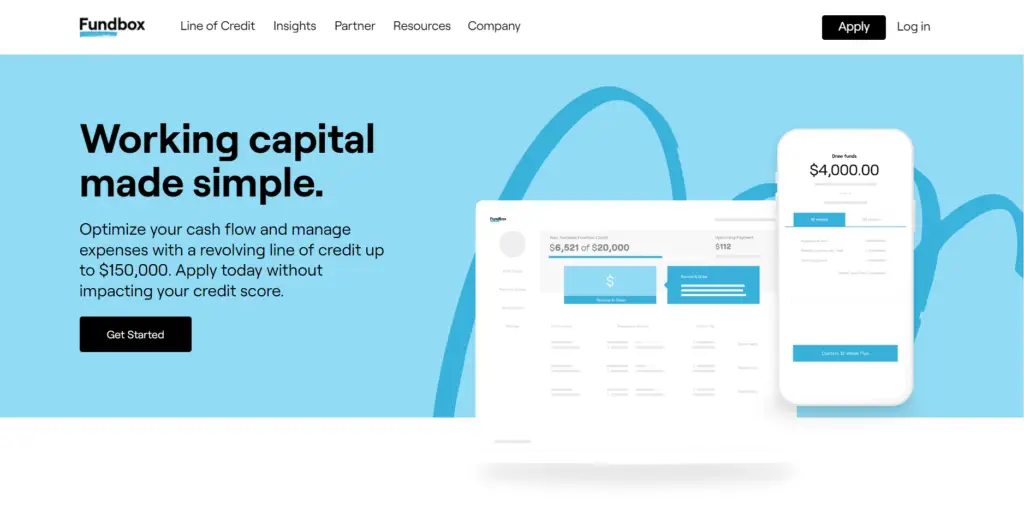

4. OnDeck – Line of credit

OnDeck offers business lines of credit for small business owners with less-than-perfect credit. The company’s financing options are designed to help businesses manage their cash flow and make purchases and can provide up to $100,000 in funding. It’s also good to know that OnDeck doesn’t require physical collateral but a personal guarantee and UCC blanket liens. Overall, it sounds like OnDeck could be a helpful solution for small business owners needing short-term financing.

Businesses can use OnDeck’s financing options in various ways, depending on their specific needs. For example, a company could use a line of credit to fill a cash-flow gap or make a large purchase they couldn’t afford upfront. On the other hand, a term loan could be used to fund a specific project or expansion.

Key features:

- Loan Process: OnDeck provides access to company financial advisors during and after the application and loan process.

- Terms: Provides short-term and long-term loans. Terms range from three to 36 months, depending on the type of loan.

- Collateral: The loans offered by OnDeck are secured. Technically, no assets are required, but the company needs a Uniform Commercial Code (UCC) filing.

- Special Documentation: Credit scores are checked via a soft inquiry, so your credit score won’t be affected by your loan application at first. They also require three months’ worth of bank statements.

- It is possible to receive cash on the same day.

- Borrowers must have a minimum credit score of 625 to qualify for this loan.

- Minimal documentation is required for the application process.

- It is an excellent way to build business credit.

- Payments are often required (daily or weekly) to repay the loan.

- A traditional lender may charge a higher interest rate than a payday loan lender.

- There is a requirement for a business lien and a personal guarantee.

5. Bluevine – Line of credit

Bluevine offers a business line of credit that can provide fast working capital for short-term borrowing needs. The company’s line of credit is designed for startups with at least six months in business and can provide up to $250,000 in funding.

Businesses can benefit from Bluevine’s financing options, including access to working capital to meet their financial obligations and grow. Companies can also apply for financing and manage their accounts easily using their online lending platform, which is designed to be user-friendly and efficient.

Key features:

- Invoice factoring: The invoice factoring service allows businesses to receive funding based on the value of their outstanding invoices, giving them a quick and easy way to access working capital.

- Term loans: Offers term loans with competitive rates and flexible repayment terms, allowing businesses to borrow the funds they need to invest in new equipment or expand their operations.

- Online tools and resources: Helps businesses manage their finances and make informed financial decisions by offering a business loan calculator, financial education resources, and a mobile app.

- Fast and easy application process: The application process is fast and easy, with most businesses receiving a decision within minutes and funding available in as little as 24 hours.

- It may take up to 24 hours for the cash to be available.

- There are multiple term lengths available to meet different financing needs.

- Requires a low minimum credit score.

- Suitable for startups, borrowers must have been in business for a minimum of six months.

- Repayments may be required every week.

- It requires a personal guarantee.

- Compared to traditional lenders, rates can be high.

6. Wells Fargo

Wells Fargo is a large financial services company that offers businesses a range of products and services, including financing options. Businesses can benefit from Wells Fargo’s financing options in several ways. Managing their finances and planning for the future can be easier with the company’s competitive interest rates and flexible repayment terms.

In addition to offering credit lines between $5,000 and $100,000, the company’s unsecured credit line comes with monthly payments due. The company’s unsecured line of credit charges an annual fee, but it waives that fee for the first year.

Key features:

- Competitive interest rates: Business owners can take advantage of competitive interest rates and flexible repayment terms to help them manage their finances efficiently.

- Personalized support: Assisting businesses in making informed financing decisions through personalized support and guidance.

- Eligibility: A small business may operate for less than two years if you apply for the Small Business Advantage line of credit.

- Turnaround time: A business owner with an open Wells Fargo account for at least one year can apply online; all prospective borrowers must apply in person. You’ll receive a decision within ten business days if you use it for an unsecured business or Small Business Advantage line of credit.

- No collateral required

- Low-interest rates available

- Rewards available

- Annual fee after the first year

- Requires at least two years in business

How can business lines of credit be beneficial?

The difference between a business line of credit and a term loan is that a business line of credit will allow you to run your business without the need to apply for a new loan every time you need to borrow money.

In addition, you can manage your cash flow better and plan for the future with less stress by having continuous access to working capital. Taking advantage of opportunities when they arise will be a lot easier when you have a line of credit that gives you the boost you need.

There are many advantages to having a business line of credit. One of the main benefits is that it is revolving, which means you can use the line whenever you need it, pay off the balance, and then use it again whenever your funds replenish. Small business owners use credit lines for several reasons. Here are some of them.

Related: Best Banks for Small Business

Secured vs. Unsecured Business Lines of Credit

Understandably, a secured business line of credit is often seen as more attractive than an unsecured one, as they do not demand personal guarantees or liens like unsecured ones. With tight business lines of credit, you must use assets such as inventory or property as collateral to receive the loan. Failure to return the credit line results in a lender having the right to seize your assets.

On the other hand, while unsecured business lines of credit don’t ask for collateral upfront, some lenders may ask for a personal guarantee or lien against your business’s assets before approving your application.

In both cases, it is essential to understand what could happen if you cannot return the loan to decide which lender and line of credit will be best for your business.

Related: Best Budgeting Software for Small Business

Business lines of credit vs. business credit cards

Business credit cards are technically lines of credit, but there are a few ways in which they differ from traditional business credit lines.

A business line of credit can be an excellent way to increase your credit limit, secure it with collateral, and provide you with actual cash when you take out a loan. Getting money with a business credit card can be done, but you will be charged a fee (usually called a cash advance fee) and a higher interest rate.

Business credit cards, however, can offer rewards or cash back for spending — something that isn’t something you could get from traditional lines of credit. Most bonuses are related to business expenses, like office supplies, gas, internet, and cable, which are usually associated with business expenses. In addition, they may also offer 0% interest promotions, which means that you will not be charged interest on your balance for a certain amount of time after you sign up for the card.

The best use of business credit cards is for small ongoing expenses and newer businesses with no established financials, while the best use of business lines of credit is for companies with large ongoing expenses and more mature companies.

Related: Can You Get a Business Loan with Bad Credit

Conclusion:

A business line of credit is a great way to get the cash you need for your business. It can cover operating expenses, expand your business, or purchase inventory.

This article has discussed the six best business lines of credit and how they can benefit your business. If you have questions about these loans, please feel free to ask in the comments section below.