Disclaimer: We sometimes use affiliate links in our content. For more information, visit our Disclaimer Page.

When investing, most people think about stocks, bonds, and other traditional investment vehicles. However, a world of alternative investments can achieve specific goals or customize a portfolio.

One such type of investment is the security market line (SML), which comprises securities considered to have low risk and high liquidity. Let’s take a closer look at the security market line (SML) and how you can use it in your portfolio.

Security market line (SML) Definition

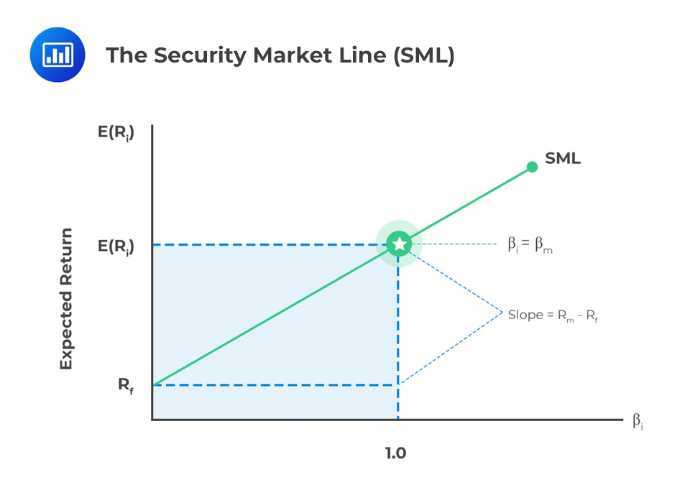

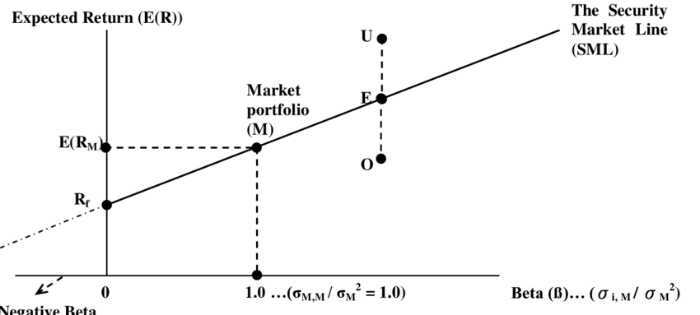

The security market line (SML) is a graphical representation of securities’ risk and return relationships. It plots risk on the x-axis and expected return on the y axis, defined as volatility or systematic risk.

In other words, the security market line illustrates how much risk an investor can expect from security in exchange for higher returns. In general, riskier securities have higher potential returns to compensate investors for taking on the risk, while less risky securities offer lower returns to compensate for their lack of risk.

Security market line (SML) Uses

The security market line (SML) is an excellent way to determine whether a given alternative investment would be a good fit for a portfolio. For example, risk-averse investors should focus on investments that plot closest to the risk-free rate (represented by a straight line parallel to the y axis). On the other hand, risk-seeking investors should seek alternatives farther from the risk-free rate.

In addition, if you plot multiple securities on a security market line, you can easily compare risk and return among them. This is particularly useful for risk-averse investors, who can use the SML to ensure they take on the lowest risk possible with the highest likelihood of meeting their goals or risk tolerance.

Security market line Example

The security market line is not just theoretical–it’s used every day by investors to help them determine how much risk to take on with their portfolios. To give you an idea of the security market line example, let’s look at two stocks and compare their risk/return profiles using the SML.

To create the examples below, we’ll use Microsoft and Twitter, two publicly traded social media stocks, to compare. For risk-free rate, we’ll use the yield on a 3-month U.S Treasury note, currently at 0.29% as of this writing.

By plotting Microsoft and Twitter on a security market line, we can get a good idea of how much risk each stock has compared to the risk-free rate. Microsoft, which is riskier than risk-free securities, has a risk/return profile that plots above the risk-free rate line; Twitter, which is less risky than risk-free securities, plots below the risk-free line.

The risk-free rate is represented by a straight line that begins at the origin and runs parallel to the risk-free rate (y-axis) until it intersects with the security market line (x-axis). The risk-free rate shows that all risk-averse investors should put their money in risk-free securities.

A risk-free asset is marketable security with a known market rate of return. It has no risk and is used as a benchmark for market returns.

Security Market Line Assumptions

The security market line is based on two primary assumptions, essential to remember when assessing your portfolio for risk. First, the security market line assumes that historical returns indicate future returns. So if stocks have averaged 7% in the past ten years, there’s a good chance they’ll average around that number into the future.

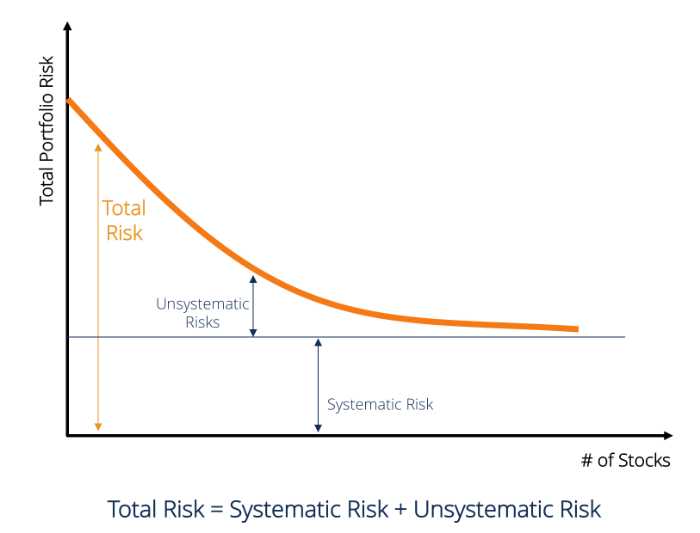

Second, the security market line assumes that all risk is systematic. If you’re interested in reducing non-systematic (“specific”) risks, then your best bet would be to invest in securities with low exposure to the relevant risk factors (i.e., if a stock doesn’t exposure its price to oil prices, it will not be impacted by a drop in oil prices).

Systematic or market risk is the factor whose fluctuation cannot be eliminated through diversification. It can affect any security in the market, and one company’s systematic risk does not reduce or eliminate another company’s systematic risk. In other words, systematic risk similarly affects all securities at a given point in time.

Security Market Line Concept

The Security market line is based on three concepts:

- The market portfolio

- The market risk premium

- Systematic risk and diversifiable risk (unsystematic risk)

For purposes of this blog, we will be working based on market returns, market risks, systematic risks, and unsystematic risks. We will discuss the SML concept further after explaining these three concepts.

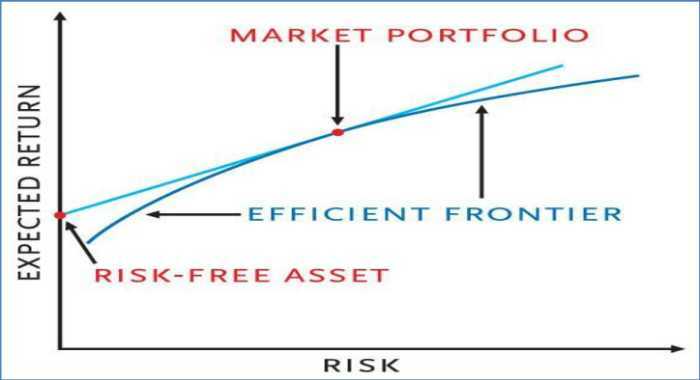

The market portfolio

The market portfolio contains all marketable assets together with the market value of these assets. Therefore, all marketable assets can be sold in a liquid market to any number of buyers without impacting the market price. On the other hand, you cannot convert non-market assets into marketable assets by selling them since there is no market for them.

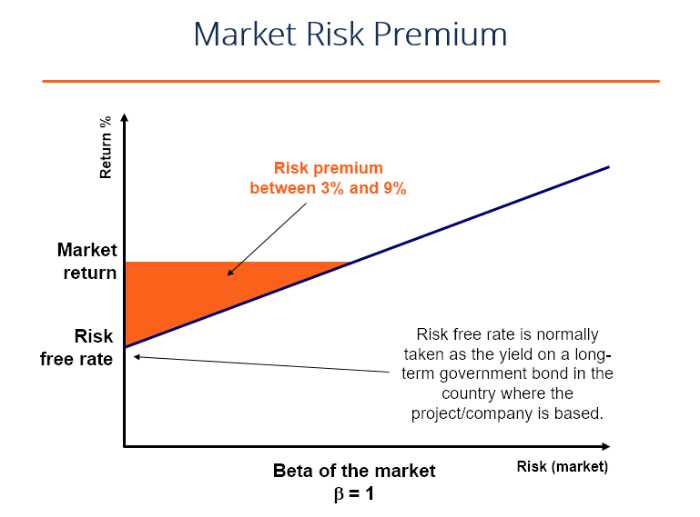

The market risk premium is the difference between total market returns and total market risks. They are not guaranteed but depend on market sentiment, measured by beta. A higher beta indicates a more significant market reaction to market-wide movements and thus a higher market risk premium.

Systematic risk and unsystematic risk

Systematic risks are market-wide risks that cannot be eliminated by diversification. Thus, market allocations should include market investments to reduce systematic market risks. On the other hand, unsystematic risks (also known as specific or non-market risks) can be reduced through diversification. As such, non-market investments should be included in market portfolios to diversify market risks.

Determine the Security market line

To determine the security market line, we need the following inputs:

1. Expected Return

First, the expected return is the minimum return that an investor expects to receive for taking on a level of risk. It is usually the arithmetic average of the historical returns over a particular time frame and can be found in any finance book or website, such as Yahoo Finance.

2. Standard Deviation of Return

The standard deviation measures the variability or volatility of an investment’s return. A statistical measure calculates how much the returns are dispersed around the arithmetic expected return. To find it, look for historical data for one year, multiply each return by its respective probability, and take an average of those products.

3. Beta

Beta measures the riskiness of a stock compared to the market, which has a beta of 1 by definition. In other words, it shows how much more or less risky an individual stock is compared to the market as a whole. The larger the number, the more volatile and risky that particular security is compared to the market.

4. Risk-Free Rate

The risk-free rate is represented by a straight line that begins at the origin and runs parallel to the risk-free rate (y-axis) until it intersects with the security market line (x-axis).

Security Market Line Formula

Enterprise value = $2,300M

Required return = 13.5%

Beta = 2.25

Standard deviation of return = 11%

Expected return = 14%

Risk-free rate = 3% (assume the U.S. 10-year treasury bond is used as a proxy for the risk-free asset) [this means that all investments in this market have an expected yearly return of 3%]

Calculation of Security Market Line

Slope = beta * standard deviation

Market line slope = 2.25 * 11% = 24.75%

Risk-free rate line slope = 3%

Using the security market line calculator and plugging in all the inputs, we get:

Expected returns on equity for this company = 14% + (24.75 – 3)% = 20.75%. This means that this company is expected to return 20.75% per year, not accounting for risk.

Capital Asset Pricing Model and the Security Market Line

Even though the security market line is often used in isolation, it’s part of a larger model called the capital asset pricing model.

The capital asset pricing model (CAPM) is a market equilibrium model that shows the relationship among expected return, systematic risk, and unique risk referred to as alpha, beta, and r-squared.

In other words, the capital asset pricing model describes how expected returns and market risk (measured by beta) are related. To use it in practice, you would estimate a security’s beta and alpha and calculate its expected return accordingly–the market consensus of what you can expect to make or lose on an investment given the amount of market risk it entails.

How does the Security market line relate to the capital market line?

The two lines are pretty similar but have a crucial difference: The security market line describes expected returns for a specific risk, whereas the capital market line represents the market as a whole.

In other words, they both illustrate how much more return an investor can expect to get for taking on a certain level of market risk. Still, they differ because the security market line only applies to a specific company or alternative investment. In contrast, the capital market line can apply across the market as a whole.

Final Thoughts

In short, The security market line is the graphical representation of how expected returns and systematic risk (measured by beta) are related. It can be used to estimate the expected return on a company’s equity while considering both its risk and the number of market risks in general.

We hope that the provided info is helpful to you. If it was, please share this blog post with your friends or family who want to learn about the security market line and expected return.

Related: Spot Market