Disclaimer: We sometimes use affiliate links in our content. For more information, visit our Disclaimer Page.

When starting a small business, one of the first things you need to do is set up a business bank account. This will allow you to manage your finances and separate your business and personal expenses. Many banks offer business accounts, so deciding which is right for you is challenging.

That’s why we’ve put together a list of the eight best banks for small businesses, along with some information on their features and pros and cons. Keep reading for more information!

✅ Banking for commercial purposes.

✅ Banking for corporations and investors.

✅ Fees are not charged

✅ Debit card issued by MasterCard

✅ Access to ATMs without a card

✅ Program for automatic savings

✅ Maintain a budget and track your progress

✅ Take advantage of mobile technology

✅ Fees are not charged

✅ Support and customer service that is good

✅ Maintaining security

✅ Products of various types

✅ Options for overdrafts

✅ You’ll get paid early

✅ Tax and expense tools integrated

✅ Access to ATMs and cash deposits

8 Best Banks for Small Business

Here are some best banks for small businesses.

1. Wells Fargo

Wells Fargo is a large multinational financial services company based in the United States. It offers various financial products and services for individuals and businesses, including checking and savings accounts, credit cards, loans, and investment services.

For small businesses, Wells Fargo offers a variety of banking and financial solutions, such as business checking and savings accounts, credit cards, loans, and lines of credit, as well as online and mobile banking services. These products and services can help small businesses manage their financial transactions, access credit, and grow their businesses.

As far as business and employee services go, Wells Fargo has the most comprehensive ones. In addition to its proprietary point-of-sale program, Wells Fargo offers many other merchant services. You can also rely on Wells Fargo to manage your business taxes, human resources needs, and employee payroll. The bank also offers financial education, advice to small businesses, networking, and mentoring.

Key features:

- Wide range of financial products: Individuals and businesses can choose from various financial products and services.

- Strong presence: Branches and ATMs are spread across a wide range of states across the United States, making it a strong presence in the country.

- Online services: Many online and mobile banking services are available.

- High-quality customer service: A high level of customer service and support is provided.

- It is one of the most active SBA lenders in the country

- There are a variety of checking and lending options available

- Management services for all types of businesses

- The terms of business loans are limited

2. KeyBank

Among the best banks for business checking accounts, KeyBank offers a range of financial products and services for individuals and businesses. It provides checking accounts, savings accounts, credit cards, loans, and investment services to satisfy the needs of everyone.

For small businesses, KeyBank offers a variety of banking and financial solutions, such as business checking and savings accounts, credit cards, loans, and lines of credit, as well as online and mobile banking services.

These products and services can help small businesses manage their financial transactions, access credit, and grow their businesses. Additionally, KeyBank offers resources and support for small businesses, including financial education and advice, networking, and mentoring opportunities.

Key features:

- Convenient account access: Using paper checks, a debit Mastercard®, online and mobile banking, and KeyBank ATMs and branches, you can access your money.

- No fees: There are no overdrafts, monthly maintenance, or minimum balance fees. That’s why the term ‘Hassle-Free’ has been coined.

- Mastercard debit card: Take advantage of chip security, tap-and-go technology, and all the benefits of Mastercard with this debit card.

- Secure online & mobile banking: Check deposits can be made via the mobile app, bills can be paid, money can be sent to family and friends, and much more.

- Checking accounts receive $25,000 in no-fee cash deposits each month

- There are low monthly fees associated with this service

- There are additional bonuses available through KeyBank Relationship Rewards

- Compared to some competitors, this lender is less active

3. Chase Bank

Chase Bank is a large national bank in the United States. It offers a range of financial products and services for individuals, small businesses, and commercial clients, including checking and savings accounts, credit cards, loans, and investment products.

It is essential to mention that Chase Bank offers a wide range of financial products and services to small businesses, including checking and savings accounts, credit cards, loans, and investment plans.

In addition to its extensive branch network and ATMs, Chase Bank is known for its commitment to providing outstanding customer service. Aside from that, the bank offers several tools and resources designed to help small business owners manage and grow their businesses, such as financial education materials and support from dedicated small business bankers.

You will also have access to a robust offering of business credit cards from Chase, such as the Ink Business Preferred Credit Card, fraud protection tools, and merchant services – all designed to help you run your business more effectively and efficiently.

Key features:

- Direct Deposit: Paychecks can be directly deposited into your checking or savings account.

- Chase QuickDeposit: You can deposit checks anywhere by taking a picture with your phone. The daily mobile check deposit limit is $2,000, and the monthly limit is $5,000.

- Cardless ATM Access: Log into your mobile wallet and enter your PIN to withdraw money at Chase ATMs without a card.

- Online Bill Pay: Online or mobile payments are available for thousands of billers.

- Automatic Savings Program: Set up a recurring transfer from your Chase checking account to your Chase savings account so you can grow your savings automatically.

- It is possible to choose from a variety of business products

- There is an excellent lineup of business credit cards available to you

- There are branches located throughout the country

- Rates of interest are kept to a minimum

- A limited number of savings options are available

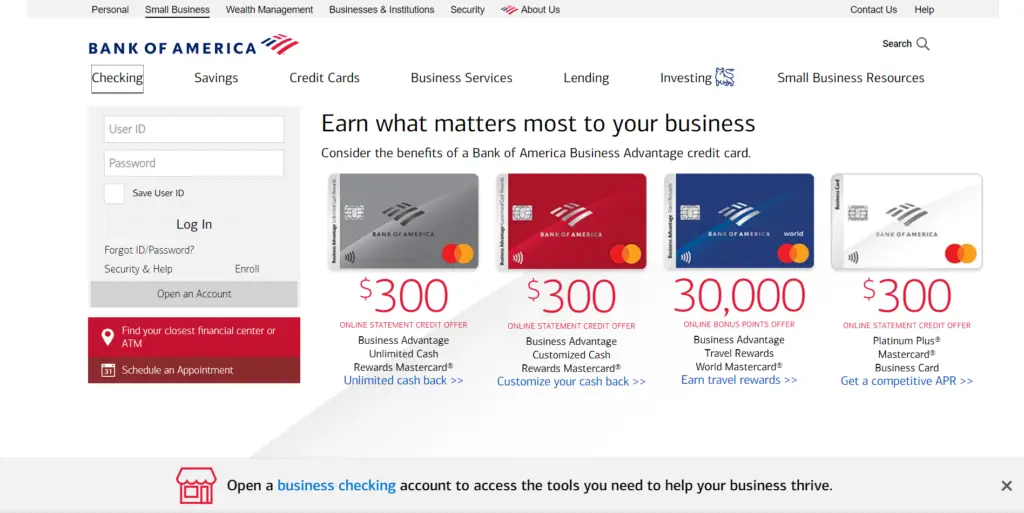

4. Bank of America

Among the many great banking options available at Bank of America for small businesses, you’ll find checking accounts, credit cards, and financial education resources tailored to your business. The Bank of America provides financing solutions tailored to specific industries, such as healthcare or agriculture, for businesses.

Two types of business checking accounts are available through Bank of America: Business Advantage Fundamentals Banking and Business Advantage Relationship Banking. The Fundamentals Account is better suited for small businesses, whereas the Advantage Account has higher minimums and is designed for larger, more established businesses.

A certain minimum balance or spending requirement can be met to waive the monthly maintenance fee for both Business Advantage Fundamentals Banking and Business Advantage Relationship Banking accounts. As well as the fundamental features of the Fundamentals account, the Advantage account offers seamless QuickBooks integration.

As a result, Bank of America is truly a national bank. In addition to its physical branches, Bank of America offers business perks such as tax preparation and point-of-sale services.

Key features:

- Manage accounts: Managing your account includes checking balances, depositing checks, viewing statements, paying bills, transferring money between accounts, and setting up alerts.

- Pay & transfer: You can pay your bills online from home, at work, or anywhere you can access an internet connection. Make secure transfers between your accounts or use Zelle to make transfers between your accounts.

- Budget & track: Spending and Budgeting help you stay on track by allowing you to create a budget and monitor your spending in real time.

- Get the mobile advantage: Create custom alerts to see when a payment is due and track your balance from almost anywhere.

- Solutions for business banking that are tailored to your needs

- The company has branches all over the country

- It is not possible to open a business savings account

- Rates of interest are low at the moment

5. PNC Bank

In the United States, PNC Bank only operates branches in about half the country. Most of its locations are located in eastern and central regions. PNC offers a variety of significant business products. The bank offers numerous online and mobile features, making it a viable option for those who live far from a branch. In addition to checking and savings accounts, PNC offers credit cards, merchant services, and a variety of loans to businesses.

Among the four options offered by PNC are Business Checking, Business Checking Plus, Analysis Business Checking, and Treasury Enterprise Plan. Each account comes with a monthly fee, although all of them can be waived aside from the Analysis Business Checking account.

For small, medium, and large businesses, PNC offers three other account options (Checking, Checking Plus, and Treasury Enterprise Plan). A certain number of free transactions and cash deposits are offered to each PNC account each month. On the other hand, the Analysis Business Checking account is designed to simplify business banking and bookkeeping.

There are more than just checking accounts offered by PNC. With PNC, you’ll have access to a wide range of financing and loan options for small businesses. Some loans don’t require collateral, while others are designed for specific purposes, such as equipment or real estate. With the bank, you can get APYs on various business savings products and available business credit cards and use the bank for merchant services.

Key features:

- User experience: You can compare accounts online, apply for a new account and learn about other PNC products on the company’s website and app.

- Fees: You should be aware of some costs associated with PNC savings accounts.

- Flexibility: Whether you prefer to open an account online or in a branch, PNC Bank offers flexibility in opening an account.

- Customer service and support: If you need assistance with your account or have questions, you can visit a PNC Branch or contact PNC support via Twitter or phone.

- Access: If you need to speak with a teller, you can use the PNC Bank mobile app or manage your accounts online.

- An extensive range of business accounts, credit cards, and services are available to you

- Banking on the go with mobile devices and online services that are easy to use

- There is a low annual percentage yield (APY)

6. Regions Bank

Besides providing personal and business banking services, Regions Bank is one of the best banks. The bank offers five business checking accounts: Simple Checking, Advantage Business Checking, Business Interest Checking, and Not-for-Profit Checking. There are fees associated with all these accounts, except Not-for-Profit Checking, but you will have relatively easy ways of waiving them.

Regions also offer four business savings accounts if you want to earn more interest on some of your balances. With Regions Bank, you can choose from a Business Savings account, a Business Premium Money Market account, or many different business CDs. Although Regions Bank’s rates are relatively low, they often pay out better than a checking account.

Regions provide a variety of other services in addition to its banking products. We offer business credit cards, secured and unsecured loans, lines of credit, equipment loans, cash management tools, merchant services, payroll, and benefits services.

Key features:

- Access to Your Savings Account: You can access your savings account online, through your mobile device, or in person

- Security: Amounts up to the maximum allowed by law are insured by the Federal Deposit Insurance Corporation (FDIC).

- Products: There are a variety of account options available at Regions Bank, which is one of its primary strengths.

- Access:: With approximately 1,500 branches and 2,000 ATMs, Regions Bank offers a wide variety

- The top 10 SBA lenders in the country

- This company offers payroll and merchant services

- Has more than one checking and savings account

- Other banks offer more free transactions and free cash deposits

7. Capital One

Capital One’s business banking options are more comprehensive than its competitors. In addition to Spark Business Banking, the bank offers individualized guidance and advice through Spark Business Banking, the platform through which it manages its business bank accounts.

In addition to checking and savings accounts, Capital One also offers loans, lines of credit, and other lending products. Capital One also offers quality credit cards and merchant services to keep your business running smoothly.

Spark Business offers two types of business checking accounts: the Spark Business Basic Checking account and the Spark Business Unlimited Checking account. There are unlimited transactions, a waived monthly service fee, and online and mobile banking options with each account.

You’ll also be able to apply for business credit cards through Capital One. Capital One offers a Business Advantage Savings account. The Capital One business card can earn you and your business many valuable rewards if used correctly. Interestingly, SmartAsset ranked one Capital One card among the top small business credit cards.

Key features:

- Bank securely: With FDIC insurance and fraud coverage, you can be assured that your online checking account is safe.

- Overdraft options: If you choose to overdraw your account, you will not be charged any fees.

- Get paid early: With early paychecks, you can access your money up to 2 days earlier than payday.

- Get help in person: To get any help you may need, feel free to visit one of their branches or cafés to bank with their friendly Ambassadors.

- Customer service is excellent both in-person and online

- There are a lot of great credit cards available

- There are no branches located throughout the country

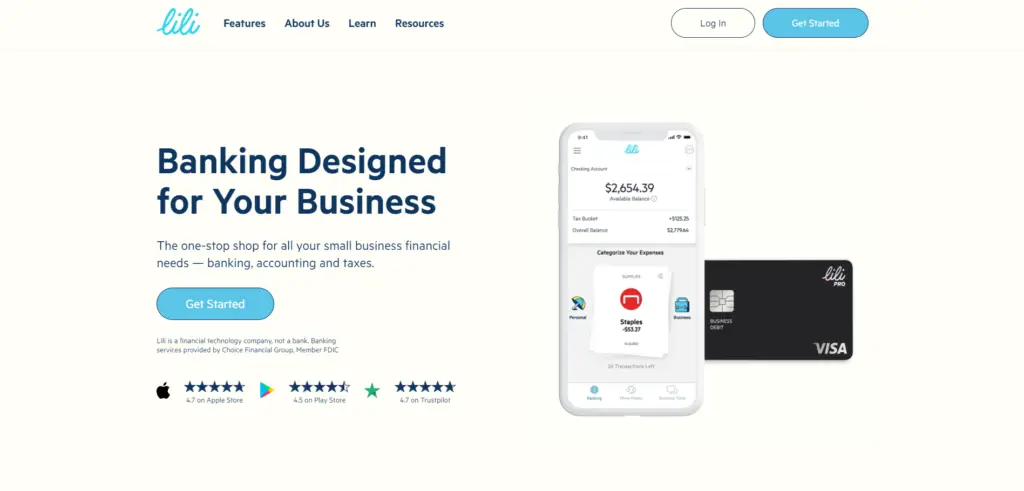

8. Lili

Lili is the perfect fit for many freelancers and businesses. From low fees to secure transfers, it’s an ideal tool for those taking their first steps in the industry; there are no minimum balance requirements or need for special assistance with setting up accounts.

Regarding scalability, Lili may not be best suited to established businesses due to its transferable amounts limit. However, this lack of capacity makes it extremely attractive as an easy-to-use alternative solution for smaller enterprises. You can use quick account setup and multiple payment gateway options when banking solely through Lili.

Key features:

- No fees: There are no monthly fees, no minimum balance requirements, and no minimum opening deposit, and you will be able to make unlimited fee-free transactions when you open a Lili bank account.

- ATM access and cash deposits: If you’re a Lili business customer or business owner, you can withdraw cash fee-free from over 32,000 MoneyPass ATMs worldwide using your Lili business debit card. The Lili app has a locator to help you find a MoneyPass ATM nearest to you.

- Integrated tools for expenses and taxes: As part of the Lili app, you can access several tools to help you manage your expenses and prepare for taxes.

- Visa Business Debit Card: When you open a business checking account with Lili, you will receive a Visa debit card in the mail within a few days of opening the account.

- There are no minimum balance requirements or hidden fees to worry about

- Cash back rewards for business purchases regularly

- With the app, you can freeze and unfreeze debit cards at any time – FDIC insured

- Very affordable

- Using an ATM to make a deposit is not possible

- There is no need to transfer funds by wire

- There are no checks to be made

What to look for in a business bank account

You should keep transaction fees in mind when shopping for the best banks for business accounts, APYs or annual percentage yields, the amount of interest you earn on your deposits within a year, and any bonus offer available for joining. A business checking account should also include the following features.

1. ATM network access.

You need to be able to access cash when needed, so you must select a bank with ATM network access in your area and beyond. In addition, you should also confirm that the bank reimburses ATM fees when you withdraw cash outside their network.

2. Minimum required deposits.

It is common for banks to require a minimum deposit amount when opening your account. Other banks may require that you maintain a minimum amount in your checking account every month to avoid a monthly fee.

3. Limits.

There are several things to consider before moving your money in and out of your account, including whether there are any limits on the amount of cash you can withdraw and deposit or whether there are monthly transaction limits.

4. Customer experience.

To find the best bank for you, it may be a good idea to decide if you are comfortable with a bank that only operates online or if you are more comfortable with a physical branch. Whatever you decide to go with, you will need to ensure that the bank has good customer service so that you can get answers quickly.

5. Digital experience.

Nowadays, whether your financial institution has a physical location, it’s always a good idea to look at what kind of mobile app or online experience it offers for on-the-go banking, regardless of whether it has a physical location.

6. Existing banking relationships.

As soon as you open a business account, consider partnering with the banks where you currently have a personal account, such as a checking or credit card account. It is always wise, however, to compare other options with external financial institutions to find out which is best suited to your business needs.

Related: Best Cash Apps for Business

Conclusion

Setting up a business bank account is one of the first steps to starting a small business. It can be tough to decide which bank is right for you, but we’ve put together a list of 8 great banks for small businesses. Each has different features and benefits, so do your research before deciding on one.

Have you set up a business bank account yet? What was your experience like? Tell us in the comments section below!